Refinancing can either be a smart financial strategy or a costly mistake. Many Americans have fallen into refinance traps that actually increased interest, extended debt timelines, and wiped out equity. This article reveals real refinance horror stories — and breaks down the exact steps to avoid them. Learn how to evaluate refinancing offers, identify lender red flags, understand true loan costs, and ensure refinancing supports long-term financial freedom rather than delaying it.

Refinancing has been billed as a financial upgrade—something that “smart homeowners do” when rates drop or when they need access to funds. But many have discovered too late that refinancing can also be a hidden trap — one that subtly shifts wealth away from the homeowner and back into the lending institution. When borrowers refinance without understanding the full impact on interest, amortization, equity, and payoff timeline, they risk financial regret.

This article dives deep into refinance horror stories experienced by everyday families — and teaches you how to avoid walking their path. Because refinancing can be beneficial — but only when done with awareness and analysis, not blind trust.

Why So Many Homeowners Fall Into Refinance Traps

Borrowers tend to concentrate on these metrics:

- What will my monthly payment be?

- What interest rate will I get?

- Can I withdraw cash from equity?

- How fast can I sign the documents?

But the real focus should be on:

- What is my total interest cost over the life of the loan?

- Am I restarting the mortgage clock?

- Am I reducing equity — or erasing it?

- Is this short-term relief hiding long-term cost?

Lenders market refinancing as a lifestyle upgrade — not a mathematical transaction. That psychological positioning works — unless you see through it.

Horror Story #1: Restarting the Mortgage Clock

“We lowered our payment… and added 15 more years to our mortgage.”

Nancy and Tom had already paid for 11 years of their original 30-year mortgage. When they refinanced, their lender emphasized:

“This refinance will reduce your monthly payment by $265!”

What they were not told clearly:

- They would restart a new 30-year term

- They would re-enter the interest-heavy first years

- They would pay interest on a compounded, extended timeline

Over the long run, their “lower monthly payment” added nearly $61,500 in additional interest.

How to avoid this:

- Never compare monthly payments only

- ALWAYS compare total interest remaining vs. interest after refinance

- Avoid extending your loan term if already years into payment

If a lender only talks about monthly savings — that’s a warning sign.

Horror Story #2: The APR vs. Rate Deception

“We signed believing our rate was 5.3%. We didn’t notice the APR was 6.4%.”

This confusion is extremely common because lenders highlight the nominal rate, not the APR.

APR includes:

- broker fees

- lender fees

- discount points

- administrative charges

- escrow adjustments

In one case, a couple signed a refinance at “5.3%” — but with fees capitalized into the loan, the true interest cost (APR) was 6.4%.

Over time, that discrepancy cost them $44,000.

How to protect yourself:

- Always ask: “What is the APR difference vs. rate?”

- Never sign based on verbal statements

- Request full disclosure documentation

- Avoid ANY lender who pressures you to sign quickly

Transparency is a right, not a favor.

Horror Story #3: The Cash-Out Catastrophe

“We refinanced to pull equity — and lost it all when housing dropped.”

Cash-out refinancing tempts borrowers with the illusion of easy money:

“You’ve earned equity — now take it out!”

But equity withdrawn is not earned — it is borrowed.

A Michigan couple took $35,000 from their equity. Then housing values dipped 9%. Overnight:

- They owed more than the home was worth

- They lost flexibility to sell

- They increased total debt

- Their net home-ownership diminished

Cash-out is only safe when used strategically.

It is dangerous when used for:

- vacations

- consumer spending

- credit card payoff

- lifestyle upgrades

- replacing cars

- discretionary splurges

Cash-out should only be used for:

- real home improvements

- value-adding renovations

- debt restructuring that lowers total interest

- high-ROI financial decisions

Otherwise — you’re just burning future equity.

Horror Story #4: ARM Refinance Backfires

“Our payment was low… until it adjusted and doubled.”

Adjustable-rate mortgages (ARMs) can look appealing:

- 1–3 year low payment

- Attractive teaser rates

- Temporarily improved affordability

But ARM refinancing invites risk — because adjustment cycles are unpredictable.

One homeowner in Nevada watched their payment move from $1,580 to $2,410 after an ARM adjustment cycle — with no recourse.

Avoid this by:

- choosing fixed rates over ARMs

- understanding maximum rate adjustments

- asking for worst-case scenario projections

- being cautious during unstable interest-rate periods

If the payment looks “too good to be true,” it probably is.

Horror Story #5: Refinancing Into Debt-Until-Death

“I refinanced at 62 — now I’ll still be paying at 88.”

Many seniors refinance late into extended mortgages to lower monthly payments.

But they unintentionally:

- extend mortgage into retirement

- pay more total interest

- restrict long-term spending flexibility

- leave less inheritance for children

For anyone 55+:

Payments should be shortened — not stretched.

Best practice for older borrowers:

- aim for final payoff before full retirement

- prioritize debt-free ownership

- avoid adding new 30-year mortgages later in life

- consider 10-year or 15-year refinancing instead

Horror Story #6: The Fee-Stacking Sucker Punch

Some lenders add:

- underwriting fees

- origination fees

- application charges

- “document prep” fees

- loan processing fees

- courier fees

- wire transfer fees

- compliance fees

- admin fees

Many borrowers don’t know they can dispute them.

Protect yourself by asking:

- “Which fees are mandatory and which are discretionary?”

- “What fees can be waived?”

- “Are you charging me for rate-lock?”

- “Why is this fee necessary?”

Lenders hate informed borrowers — because informed borrowers negotiate.

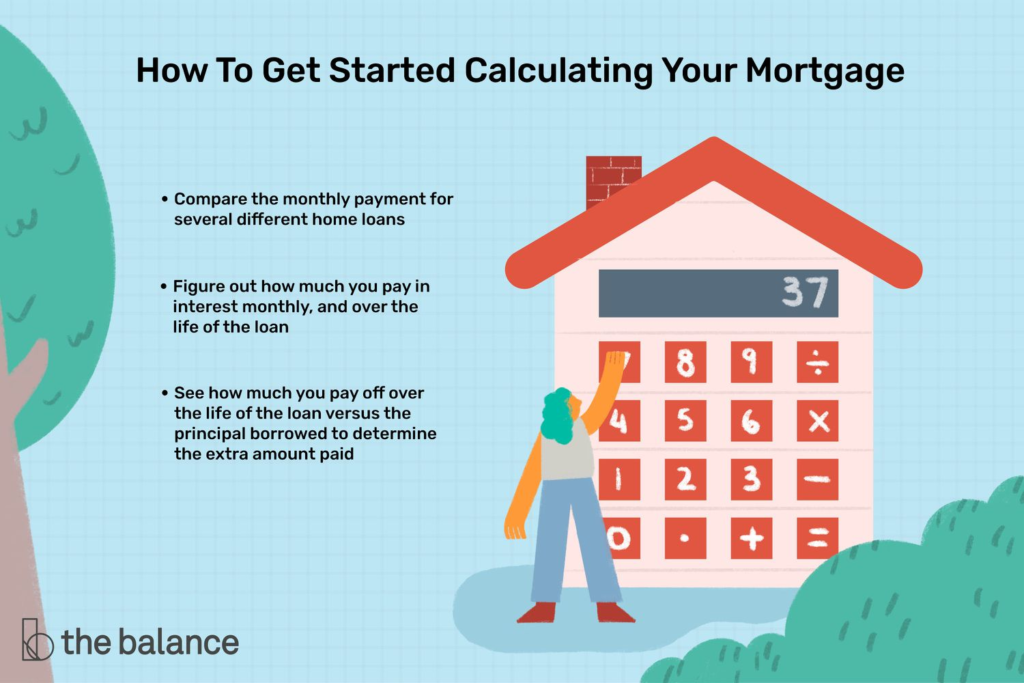

What Smart Refinancers Do Differently

Before refinancing, smart borrowers:

- ask hard questions

- review total interest costs

- use mortgage payoff calculators

- read amortization tables

- compare multiple lenders

- delay if conditions are not ideal

Refinancing is a strategy — not a routine.

10 FAQs About Refinancing Horror Stories and How to Avoid Them

1. Can refinancing actually cost more even if the monthly payment drops?

Yes — lowering the payment can increase total interest dramatically over time.

2. Should you ever restart a 30-year mortgage after already paying for years?

Rarely — unless shortening later or factoring in strategic goals.

3. Is cash-out refinancing usually smart?

Only when cash is used to increase financial value — not consumption.

4. Is the APR more important than the interest rate?

Yes — APR reveals the true cost of the mortgage.

5. Are adjustable-rate mortgages risky?

Yes — payments can increase significantly after adjustment periods.

6. Is refinancing bad for older homeowners?

It can be — especially if it creates long-term financial obligation into retirement.

7. Can fees be negotiated?

Many lender fees are negotiable — especially origination and processing fees.

8. Should any borrower trust a lender’s recommendation at face value?

Never — verify with math and third-party tools.

9. How do I know if refinancing is actually beneficial?

Compare total interest, loan length, break-even timeline, and payoff horizon.

10. What’s the biggest refinancing red flag?

When a lender emphasizes monthly payment savings — and avoids discussing total lifetime cost.

Final Takeaway: Refinancing Is Not the Enemy — Blind Agreements Are

Refinancing can be:

- transformational

- financially beneficial

- debt-reducing

- budget-optimizing

But that only happens when borrowers:

- do the math

- read the terms

- examine long-term cost

- understand interest behavior

- question lender recommendations

Refinancing is a financial tool — and like any tool, it can build or destroy, depending on how it’s used.