Refinancing can reduce your monthly mortgage payment, but banks often downplay additional costs that borrowers fail to calculate — including origination fees, title charges, appraisal costs, underwriting fees, and hidden interest refresh penalties. This in-depth guide explains when refinancing is beneficial, when it backfires, how to calculate the break-even timeline, and the psychological tactics lenders use to encourage refinancing decisions that may not truly benefit homeowners.

Refinancing is often advertised as the smartest financial strategy for homeowners who want to lower their mortgage payments or capitalize on lower interest rates. But what banks rarely explain upfront is that refinancing is not simply a “reset button” that magically makes your mortgage cheaper. Instead, it is a financial transaction full of hidden costs, timing traps, psychological triggers, and long-term consequences that many homeowners never evaluate correctly.

For millions of Americans, refinancing feels like the right move. But is it truly beneficial? That depends entirely on how deeply you understand the hidden costs that banks don’t put on the brochure — and whether you make decisions based on total lifetime cost rather than monthly payment comparison.

Why Americans Are So Easily Persuaded to Refinance

Banks and lending institutions spend millions every year to promote refinancing messaging emphasizing:

- “Lower your monthly payment”

- “Save thousands on interest”

- “Unlock the equity in your home”

- “Get cash-back refinancing”

- “Take advantage of today’s great rate!”

These messages work because they tap into emotional and immediate pain-relief psychology.

If someone is struggling with:

- high bills

- childcare expenses

- medical costs

- credit card debt

- inflation-driven lifestyle expenses

…the idea of lowering a mortgage payment by even $200 a month feels like a lifeline. And for many, the immediate relief overshadows the long-term financial picture.

Banks know this — and rely on it.

What Homeowners Think Refinancing Costs vs. Reality

Most homeowners expect to pay:

- basic closing fees

- perhaps a credit check

- maybe some document charges

But the actual refinancing costs often include:

- loan origination fees

- mortgage broker fees

- title insurance

- appraisal fees

- escrow reserves

- recording fees

- attorney or settlement fees

- prepaid interest

- discount points to “buy down the rate”

- taxes depending on state regulations

- administrative service charges

- underwriting fees

Most borrowers only discover these as they are signing — not while deciding.

Many are stunned when the final expense sheet shows that refinancing can cost $4,000–$12,000 depending on state and loan type.

According to Freddie Mac, the average refinance closing cost in the U.S. is around $5,000 — and that does not include prepaid interest or escrow deposits.

The Single Most Misleading Refinancing Outcome

Here is the biggest misunderstanding in refinancing:

A lower monthly payment does NOT necessarily mean lower total cost.

Real-life example:

Angela refinanced her $300,000 mortgage from 5.1% to 4.4%.

Her monthly payment decreased by $176.

She was thrilled.

But…

She had 23 years left on the original mortgage.

After refinancing, she now had 30 years remaining.

Result?

She will pay $38,900 MORE in total lifetime interest — even though her monthly payment is lower.

Angela is not unique. This scenario happens every day.

The True Interest Curve Trap Banks Don’t Explain

Your mortgage interest is front-loaded.

Meaning:

You pay most of your interest upfront — in the early years of the mortgage.

By year 7–10, most payments finally begin hitting principal instead of interest.

When you refinance:

You go back to year 1

back to the front of the interest curve

and back to paying more interest than principal

You restart interest on money you already paid down.

Example:

You owe $240,000 remaining on your original loan.

You refinance.

Now interest begins again as though the $240,000 is brand new debt — even though you have already paid tens of thousands in previous interest.

This is one of the most profitable features of lending.

Refinancing: When It Makes Sense (Smart Scenarios)

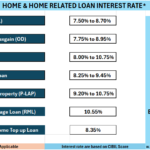

Refinancing can be a winning move when:

- Switching from a 30-year to a 15-year mortgage

- Eliminating PMI (Private Mortgage Insurance)

- Securing a rate drop of >1.0%

- Income is stable and pay-off horizon is realistic

- You will stay in the home for 7–10 years or longer

- You intend to pay aggressively to shorten the payoff timeline

For disciplined and financially strategic homeowners, refinancing can create meaningful advantages.

Refinancing Should Be Avoided When:

- You restart the mortgage timeline unnecessarily

- You have already paid off a significant amount of interest

- You plan on moving soon

- You’re doing it solely to “free monthly cash”

- You’re using refinancing to fund discretionary spending

- The savings per month are too small

- Costs exceed projected savings

Many homeowners mistakenly trade long-term financial security for short-term comfort.

Break-Even Analysis: The Real Decision Tool

Before refinancing, calculate:

Break-Even Time = Total Refinancing Fees / Monthly Savings

Example:

Refinancing cost = $5,600

Monthly savings = $140

Break-even = 40 months (~3.3 years)

If you plan to move, retire, or sell before that — refinancing loses money.

The Cash-Out Refinance Warning (The Debt Illusion)

Banks market cash-out refinancing as smart wealth access:

- “Use your equity”

- “Your home can finance your dreams”

- “Tap into unlocked value”

But what’s happening mathematically?

You increase:

- loan balance

- total interest owed

- repayment term

- financial dependency on borrowed funds

People “use equity” to:

- pay off credit cards

- renovate

- travel

- invest

- live beyond current affordability

But this is not “using equity.”

This is re-borrowing debt you previously paid off.

The Retirement-Age Refinancing Trap

Many Americans refinance at 50–60 years old.

Their reasoning:

- “I want to reduce monthly payments.”

- “I’ll have more retirement flexibility.”

Reality:

They may still owe a mortgage at age 75 or older.

With:

- reduced income

- increased health costs

- fixed cost of living

- potential financial vulnerability

Refinancing late in life can turn a once-manageable mortgage into a late-life financial anchor.

10 Essential FAQs About Refinancing (SEO-optimized)

1. Does refinancing always save money?

No. It can reduce monthly payments but increase lifetime interest — depending on term length and structure.

2. How much does refinancing actually cost?

Typically 2–6% of the loan value — often between $4,000–$12,000, depending on state and lender.

3. Does refinancing restart interest?

Yes — it resets amortization, meaning you pay more interest in the early years again.

4. When is refinancing worth it?

When it lowers total lifetime interest and/or reduces the term length (e.g., 30-year to 15-year).

5. Does refinancing hurt your credit?

It can temporarily — due to hard inquiries and scoring adjustments.

6. Will refinancing remove PMI?

Yes, if you have at least 20% equity.

7. Should I refinance if I’m planning to move soon?

No — short-term ownership rarely benefits from refinancing.

8. What’s the best refinancing credit score range?

620+ is required for most loans, but 740+ typically gets the best rates.

9. Do I always need an appraisal to refinance?

Most conventional refinances require one, unless using streamlined VA/FHA programs.

10. What’s the biggest refinancing mistake people make?

Focusing on monthly payment — not total loan cost over time.

Final Conclusion: Refinancing Is Not About Today — It’s About Tomorrow

Refinancing is only beneficial when:

- total interest paid decreases

- equity strengthens faster

- repayment timeline shortens

- financial stability increases

But refinancing is harmful when:

- total lifetime interest increases

- mortgage timeline extends

- debt is pushed into retirement years

- monthly savings are merely psychological

The key is not whether refinancing makes next month easier.

The key is whether it makes the next 20 years better.