Choosing the right mortgage can save first-time homebuyers tens of thousands of dollars—but most buyers never explore their best options. This in-depth guide explains seven powerful mortgage programs designed specifically for first-time buyers, with real-life examples, expert insights, and practical advice to help you buy sooner, lower your monthly payments, and reduce long-term financial stress.

Introduction: Why Your Mortgage Choice Matters More Than the Home Price

When first-time buyers think about buying a home, almost all their attention goes to the listing price. They compare homes, neighborhoods, school districts, and square footage—yet spend surprisingly little time choosing the mortgage that will follow them for the next 15 to 30 years.

That’s a costly mistake.

Your mortgage determines:

- How much cash you need upfront

- Your monthly payment flexibility

- How much interest you’ll pay over time

- Whether you feel financially comfortable—or stretched

According to the Consumer Financial Protection Bureau (CFPB), many first-time buyers could save tens of thousands of dollars over the life of their loan by choosing a mortgage better aligned with their situation. Unfortunately, many buyers accept the first loan they’re offered simply because it’s familiar.

This article breaks down seven mortgage options that can dramatically reduce costs for first-time buyers, explaining who each option is best for, the trade-offs involved, and how real people used them to buy homes more affordably.

Why First-Time Buyers Often Choose the Wrong Mortgage

Most first-time buyers don’t choose a bad mortgage intentionally—they choose a default one.

Common reasons include:

- Assuming 20% down is required

- Believing conventional loans are the only “safe” option

- Not knowing government-backed programs exist

- Feeling overwhelmed by loan terminology

- Trusting lenders to automatically offer the best deal

But lenders qualify borrowers—they don’t automatically optimize savings.

The smartest buyers understand that the right mortgage is highly personal and depends on credit profile, savings, income stability, and long-term plans.

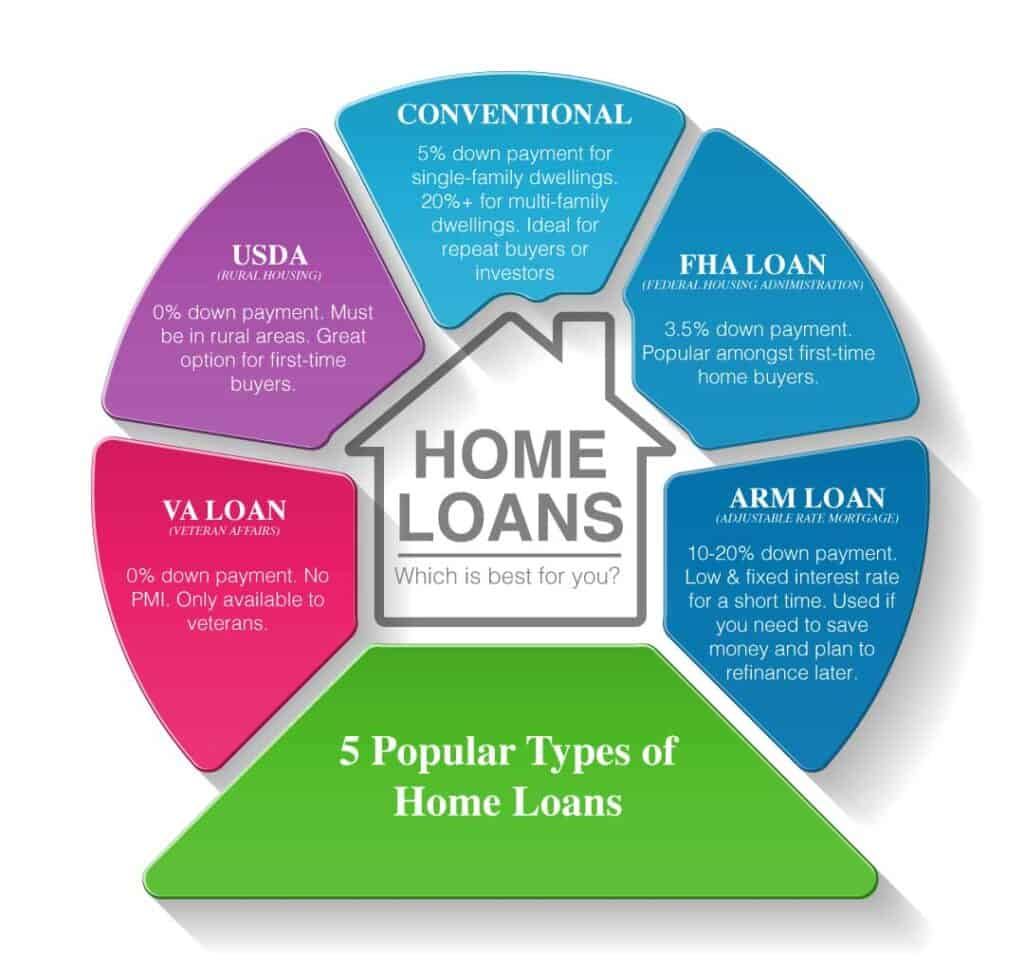

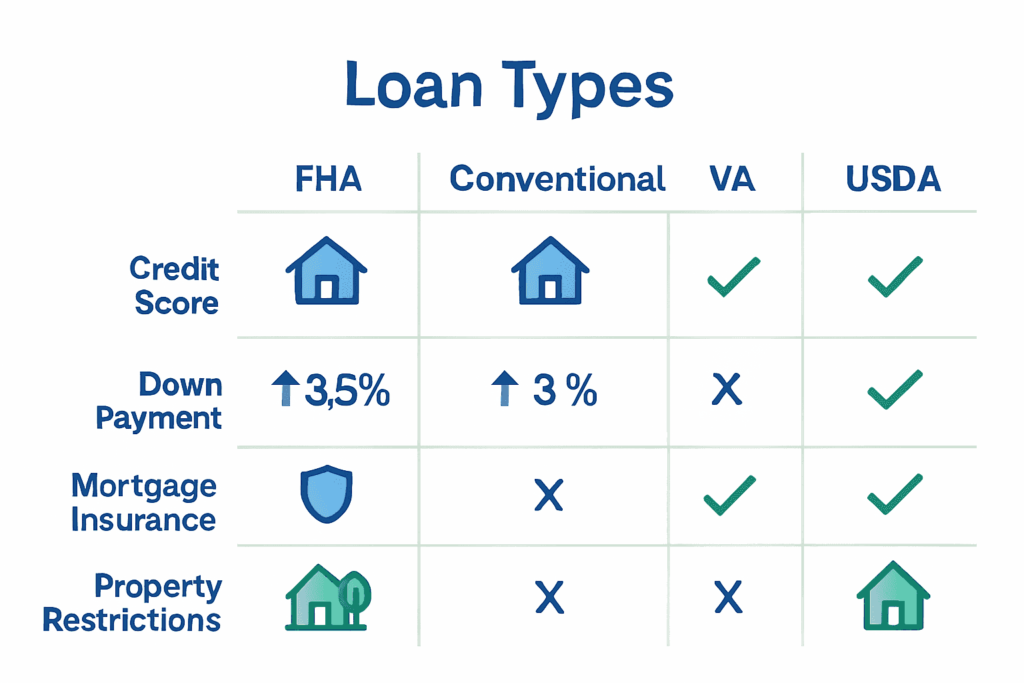

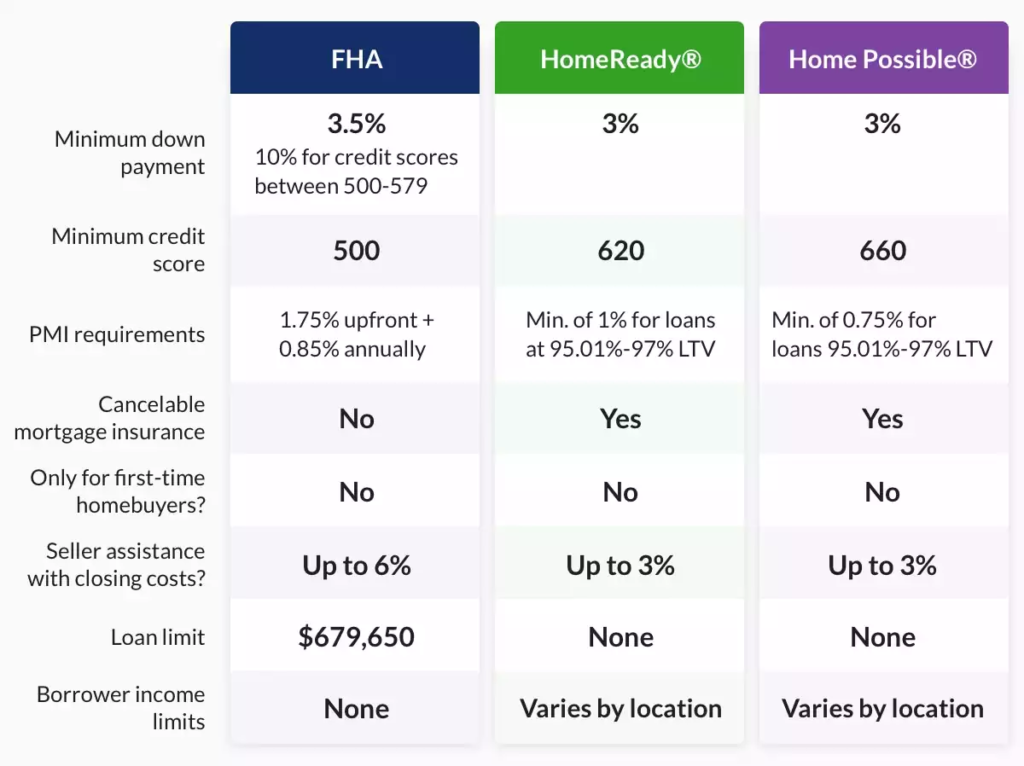

Mortgage Option #1: FHA Loans — Flexible Credit, Low Down Payment

Federal Housing Administration (FHA) loans are one of the most widely used programs for first-time buyers, especially those with limited savings or average credit.

FHA loans allow:

- 3.5% down payment

- Lower credit score thresholds

- More flexible underwriting standards

These loans are ideal for buyers who:

- Are early in their credit journey

- Have had past credit issues

- Want to preserve cash

Real-Life Example

Samantha, a first-time buyer in Michigan, had a 635 credit score and $15,000 saved. A conventional loan required a much larger down payment. With an FHA loan, she bought her home with 3.5% down, keeping cash for emergencies.

Trade-Off to Understand

FHA loans require mortgage insurance premiums (MIP) that typically last for the life of the loan unless refinanced.

Mortgage Option #2: Conventional 3% Down Loans — Lower Long-Term Costs

Many buyers still believe conventional loans require 20% down. That’s no longer true.

Programs such as:

- Fannie Mae HomeReady®

- Freddie Mac Home Possible®

allow eligible first-time buyers to put down as little as 3%.

These loans work best for buyers with:

- Credit scores around 660 or higher

- Stable income

- Moderate savings

Real-Life Example

A couple in North Carolina purchased a $360,000 home with just $10,800 down using a 3% conventional loan. Their private mortgage insurance automatically dropped once they reached sufficient equity—saving thousands compared to FHA insurance.

Why This Option Saves Money

- Lower long-term insurance costs

- PMI can be removed

- Strong resale and refinance flexibility

Mortgage Option #3: VA Loans — One of the Best Benefits for Eligible Buyers

For eligible service members, veterans, and surviving spouses, VA loans are among the most powerful mortgage tools available.

VA loans offer:

- Zero down payment

- No private mortgage insurance

- Competitive interest rates

According to the U.S. Department of Veterans Affairs, VA borrowers save hundreds of dollars per month compared to similar conventional loans.

Real-Life Example

A veteran in Texas purchased a $425,000 home with no down payment and no PMI. His monthly payment was significantly lower than friends who bought similar homes with conventional loans.

Mortgage Option #4: USDA Loans — Zero Down Beyond the City Core

USDA loans are often misunderstood. They’re not just for farms or remote areas.

Many suburban and small-town communities qualify, and income limits are often higher than buyers expect.

USDA loans offer:

- 100% financing

- Lower mortgage insurance than FHA

- Competitive interest rates

Real-Life Example

A first-time buyer couple purchased a home 25 miles outside a major metro area using a USDA loan—saving over $28,000 upfront by avoiding a down payment.

Mortgage Option #5: Adjustable-Rate Mortgages (ARMs) — When Used Strategically

Modern adjustable-rate mortgages (ARMs) are far safer than those from the pre-2008 era.

ARMs can be smart for buyers who:

- Plan to sell or refinance within 5–7 years

- Expect income growth

- Want lower initial payments

Real-Life Example

A tech professional in Seattle chose a 5/1 ARM and saved over $20,000 in interest during the first five years—well before planning to move.

Important Reminder

ARMs should be chosen intentionally, with a clear exit strategy.

Mortgage Option #6: State and Local First-Time Buyer Programs

Many states, counties, and cities offer down payment assistance (DPA) and special loan programs—but they’re often underused.

According to HUD, thousands of eligible buyers never apply simply because they don’t know these programs exist.

Programs may include:

- Grants

- Forgivable loans

- Deferred-payment second mortgages

Real-Life Example

A buyer in California received $15,000 in down payment assistance, allowing them to buy sooner without draining savings.

Mortgage Option #7: Temporary Rate Buydowns — Lower Payments Early On

A rate buydown temporarily lowers your interest rate, often paid by the seller as a concession.

A common structure is the 2-1 buydown:

- Year 1: 2% lower rate

- Year 2: 1% lower rate

- Year 3: Full rate

Why This Helps First-Time Buyers

- Easier transition into ownership

- Lower payments during early years

- Time for income growth

How to Choose the Right Mortgage for Your Situation

The best mortgage depends on:

- Credit profile

- Savings and cash flow

- Income stability

- Length of planned ownership

- Risk tolerance

Smart Buyer Perspective

- Approval is a ceiling, not a goal

- Cash flow matters more than maximum leverage

- Flexibility protects peace of mind

Common Mortgage Myths That Cost Buyers Thousands

- You need 20% down to buy

- FHA loans are always worse

- ARMs are dangerous by default

- Assistance programs are rare

- Your lender automatically offers the best option

Each myth prevents buyers from saving money.

Frequently Asked Questions (SEO-Optimized)

1. What is the best mortgage option for first-time buyers?

Ans. The best mortgage depends on credit, income, savings, and long-term plans. FHA, conventional 3% down, VA, and USDA loans are the most common first-time buyer options.

2. Can first-time buyers really buy a home with little money down?

Ans. Yes. FHA loans allow 3.5% down, conventional loans allow 3% down, and VA and USDA loans allow zero down for eligible buyers.

3. Are FHA loans bad for first-time buyers?

Ans. No. FHA loans are helpful for buyers with limited savings or lower credit, though mortgage insurance costs should be considered.

4. What credit score do I need as a first-time buyer?

Ans. FHA loans may allow scores as low as 580, while most conventional loans require scores around 660 or higher.

5. Who qualifies for VA loans?

Ans. Many active-duty service members, veterans, National Guard members, and eligible surviving spouses qualify.

6. Do USDA loans only apply to rural farmland?

Ans. No. Many suburban and small-town areas qualify under USDA eligibility maps.

7. Are adjustable-rate mortgages risky?

Ans. ARMs can be safe when used strategically with a clear plan to sell or refinance before adjustments occur.

8. Can first-time buyers get help with down payments or closing costs?

Ans. Yes. Many state and local programs offer grants or assistance for qualified buyers.

9. Should first-time buyers compare multiple lenders?

Ans. Absolutely. Shopping lenders can save thousands over the life of a loan.

10. How much money can the right mortgage save a buyer?

Ans. Depending on the program, buyers can save tens of thousands in interest, insurance, and upfront costs.

Final Thoughts: Your Mortgage Is a Long-Term Financial Decision

Many first-time buyers spend months choosing a home—but only hours choosing a mortgage.

That imbalance can cost more than the home itself.

When you understand your mortgage options, you gain leverage, flexibility, and confidence. The right mortgage doesn’t just help you buy—it helps you stay comfortable long after closing day.