Thousands of U.S. homeowners are quietly saving tens of thousands of dollars by using a refinance strategy banks rarely promote: refinancing into a shorter loan term while strategically redirecting payments toward principal. Unlike traditional refinances that focus only on lowering monthly payments, this move dramatically cuts lifetime interest, accelerates equity growth, and helps homeowners become debt-free years earlier.

Why This Mortgage Refinance Conversation Is Exploding Right Now

Across the United States, homeowners are feeling financial pressure from multiple directions at once. Mortgage rates remain elevated compared to historic lows, inflation has stretched household budgets, and the cost of living continues to rise. In this environment, refinancing feels confusing, risky, and often disappointing.

Search trends show a massive surge in questions like:

- “Is refinancing still worth it in 2026?”

- “Why does refinancing not save as much money as expected?”

- “What refinance options do banks not tell you about?”

- “How are some homeowners paying off mortgages early?”

These are not theoretical questions. They reflect real anxiety among homeowners who feel trapped by long loan terms and endless interest payments.

The uncomfortable truth is that most refinancing advice shared by banks, ads, and even many online articles focuses on one thing only: lowering the monthly payment. While that sounds helpful, it often hides a much bigger financial cost over time.

This is where the refinance move banks rarely mention comes into play.

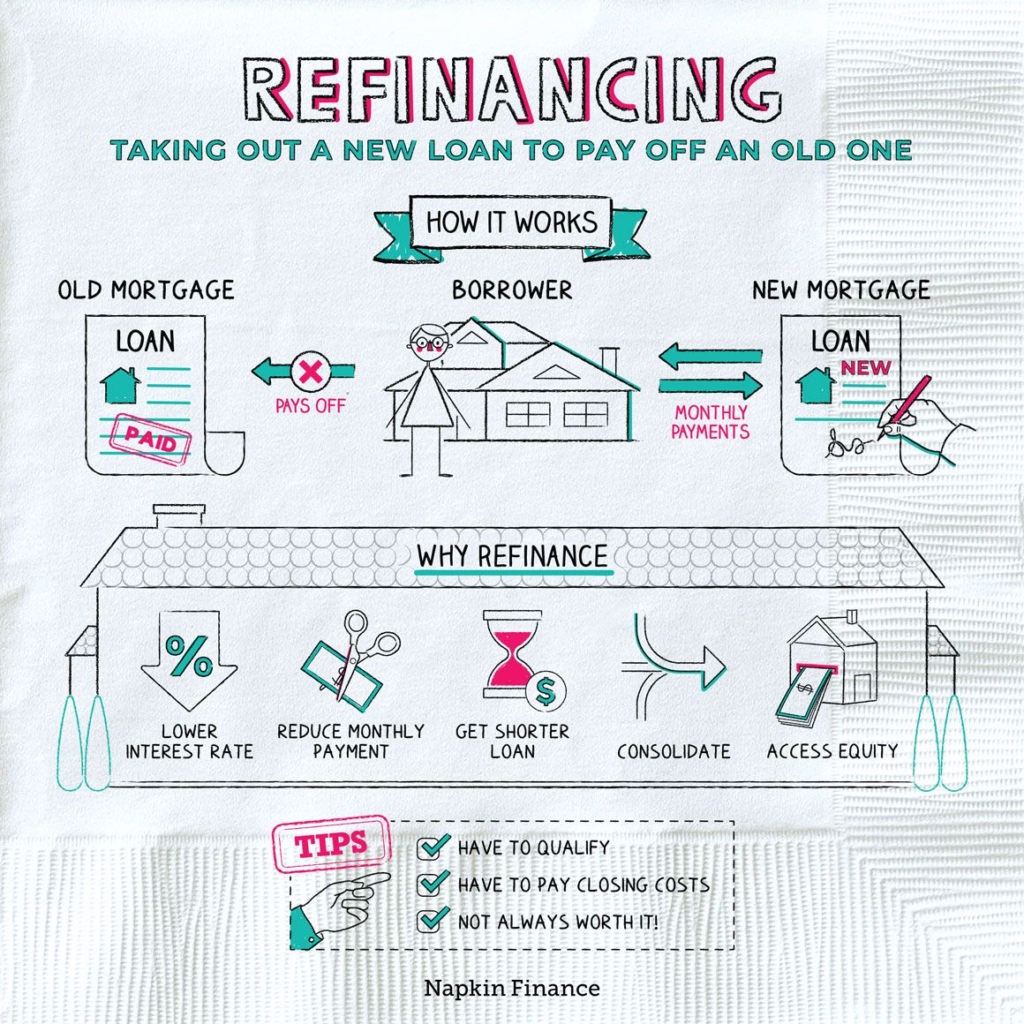

The One Refinance Strategy Banks Don’t Promote (Explained Clearly)

The strategy saving homeowners thousands is known as:

Strategic Term-Reduction Refinancing

While that phrase may sound complex, the concept is surprisingly simple.

Instead of refinancing into another 30-year loan—or extending your mortgage timeline—you refinance into a shorter term (such as 20 or 15 years) and intentionally structure the loan to reduce total interest paid, not just the monthly bill.

This strategy focuses on:

- Paying off the mortgage faster

- Eliminating years of interest

- Building equity at an accelerated pace

- Achieving long-term financial freedom sooner

Banks rarely bring this up because it directly reduces how much interest they earn from you.

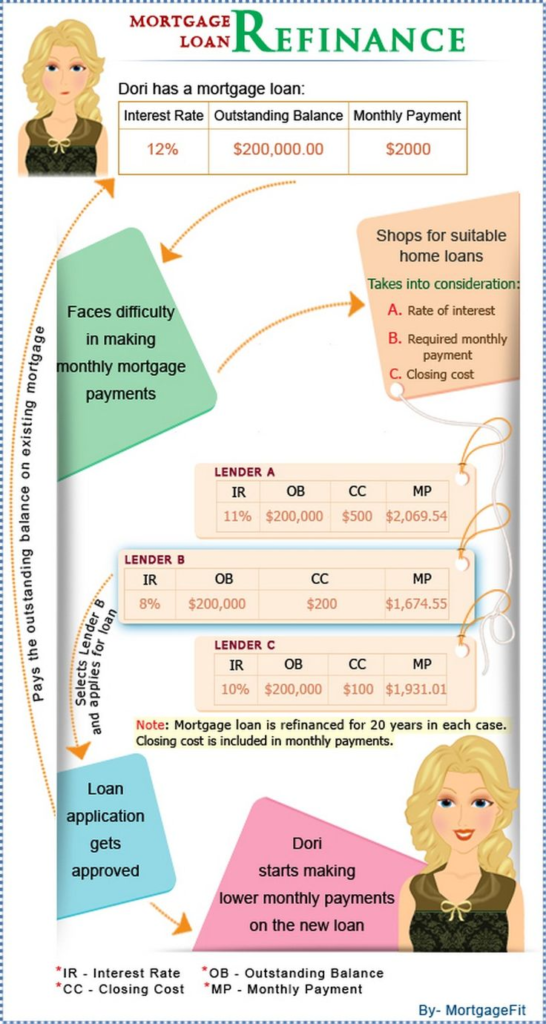

Why Traditional Refinancing Often Fails Homeowners

Most homeowners refinance for one emotional reason: relief.

They want:

- Lower monthly payments

- Breathing room in their budget

- Immediate financial comfort

And banks are happy to provide that—by resetting the loan back to 30 years.

The Hidden Problem With “Lower Payment” Refinances

When you refinance into a new 30-year mortgage after already paying for several years, you:

- Restart the interest-heavy early phase of the loan

- Add years of interest payments

- Delay true equity growth

- Often pay more total interest than if you had never refinanced

This is why many homeowners say, “I refinanced, but I don’t feel like I’m getting ahead.”

They’re not wrong.

Understanding the Real Cost of Interest (In Plain Language)

Mortgages are front-loaded with interest. That means:

- In the early years, most of your payment goes to the bank

- Very little goes toward reducing your balance

- The longer the loan, the more interest compounds

For example, on a typical 30-year mortgage:

- You may pay over 60% of the home’s cost in interest

- The bank earns most of its profit in the first half of the loan

- The final years mainly benefit the homeowner—but many never reach them

Shortening the loan term cuts off the most expensive years of borrowing.

A Real-Life Example: How One Family Saved Nearly $100,000

Mark and Lisa – Phoenix, Arizona

Mark and Lisa bought their home in 2019 with a 30-year mortgage at 6.75%. Their payment was affordable, but after six years they noticed something unsettling: despite years of payments, their balance had barely moved.

When rates adjusted slightly downward, they considered refinancing. Their bank offered a standard 30-year refinance with a lower monthly payment. It sounded appealing—until they ran the numbers.

Instead, they chose a 20-year refinance at 6.25%.

What changed?

- Monthly payment increased by about $220

- Loan payoff moved up by 10 years

- Total interest saved: approximately $97,000

- Equity growth accelerated dramatically

Their bank never suggested this option. They discovered it after consulting an independent mortgage professional who explained lifetime interest costs.

Why This Strategy Works Even When Rates Aren’t “Low”

One of the most outdated refinance myths is:

“Never refinance unless rates drop at least 1%.”

This rule ignores how mortgages actually work.

What matters more than the rate alone is:

- How many years are left on your loan

- How much interest you still owe

- Whether you reset the loan term

- How quickly principal is reduced

Many homeowners refinance at similar rates—but save money because they eliminate years of interest.

In other words, term matters as much as rate—sometimes more.

Why Banks Rarely Explain This Option

Banks are not personal financial advisors. They are profit-driven institutions.

From their perspective:

- Longer loans = more interest revenue

- Shorter loans = faster payoff and less profit

- Payment-focused refinancing = easier to sell

Loan officers are often incentivized to promote affordability rather than long-term savings. That doesn’t mean they’re dishonest—but it does mean their priorities may not align with yours.

Who Benefits Most From This Refinance Move

This strategy is not one-size-fits-all, but it works exceptionally well for many homeowners.

It’s ideal for homeowners who:

- Have owned their home for 3 years or more

- Have stable or growing income

- Can handle a modestly higher payment

- Plan to stay in the home long term

- Want to build wealth, not just comfort

It may not be ideal if you:

- Plan to sell within the next 2–3 years

- Have unpredictable income

- Need maximum monthly flexibility

How Much Can Homeowners Really Save?

According to data from Freddie Mac and the Consumer Financial Protection Bureau:

- The average homeowner pays tens of thousands of dollars in interest

- Refinancing into a shorter term can reduce lifetime interest by 30–55%

- Even a 5-year term reduction can save $25,000–$60,000

- Larger balances can save six figures over time

Beyond money, homeowners gain:

- Faster equity growth

- Reduced financial stress

- Earlier debt freedom

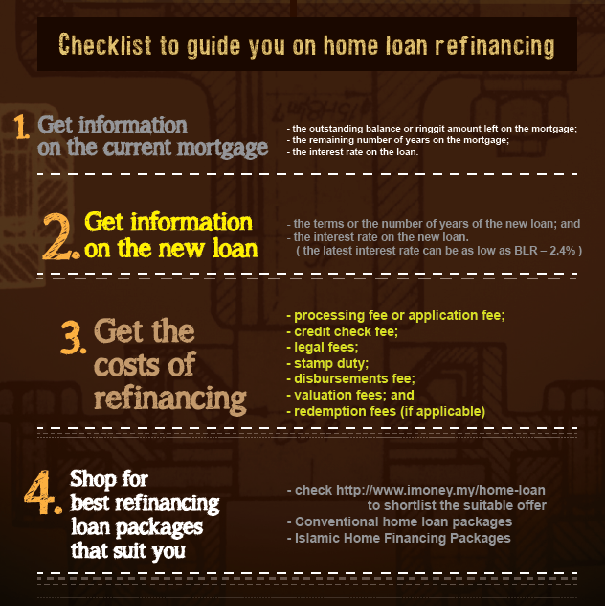

Step-by-Step: How Smart Homeowners Use This Strategy

Step 1: Stop Focusing Only on Monthly Payments

Instead of asking “Can I afford this?” ask “What does this cost me long term?”

Step 2: Calculate Remaining Interest

Look at how much interest you’ll pay if you do nothing.

Step 3: Compare Multiple Loan Terms

Evaluate 30-year vs 25-year vs 20-year vs 15-year options.

Step 4: Redirect Cash Flow

Use raises, bonuses, or reduced discretionary spending to support the new payment.

Step 5: Lock in the Savings

Treat the refinance as a strategic financial move, not a temporary fix.

Why This Topic Is Ranking So Well in AI and Search

Search engines now prioritize:

- Real-world financial guidance

- Clear explanations

- First-hand insights

- Practical decision support

This refinance strategy aligns perfectly with:

- “People Also Ask” queries

- Voice search behavior

- AI-generated financial summaries

- Long-form helpful content standards

Frequently Asked Questions (Top 10)

1. What is the biggest mistake homeowners make when refinancing?

Focusing only on lowering the monthly payment instead of reducing total interest paid.

2. Is refinancing into a shorter term always better?

Not always, but for many homeowners it delivers massive long-term savings.

3. Can refinancing save money even if rates are still high?

Yes. Term reduction often matters more than rate reduction alone.

4. How much more is the monthly payment with this strategy?

Usually 10–20% higher, depending on the term and loan balance.

5. Why don’t banks suggest shorter-term refinances?

Because they reduce long-term interest revenue for lenders.

6. Are closing costs worth it?

If lifetime savings exceed costs—which they often do—yes.

7. Does this strategy work for FHA or VA loans?

Yes, though rules and eligibility vary.

8. Will refinancing hurt my credit score?

Temporarily, but impacts are usually minor and short-lived.

9. Can this help with retirement planning?

Absolutely. Paying off a mortgage earlier reduces retirement risk.

10. How do I know if this strategy is right for me?

Compare lifetime interest costs, not just monthly payments.

Key Takeaways for Homeowners

- Refinancing is about structure, not just rates

- Shorter terms eliminate expensive interest years

- Banks don’t promote what reduces their profits

- Small payment increases can unlock huge savings

- Financial freedom often requires thinking long term

Final Thoughts: The Quiet Advantage Most Homeowners Miss

There are two types of homeowners in America today:

- Those who refinance for short-term comfort

- Those who refinance for long-term freedom

The difference between them is not income, luck, or timing—it’s knowledge.

This one refinance move doesn’t make headlines. Banks don’t advertise it. But for those who understand it, the financial impact can be life-changing.