Many borrowers unknowingly accept loan terms containing hidden traps — from misleading rates to deceptive repayment schemes and fees buried deep in documentation. This article reveals the most dangerous red flags in personal loan offers and explains how to recognize and avoid predatory terms. With real-life examples, clarity-focused analysis, and practical advice, this guide helps you make smart borrowing decisions and avoid financial harm.

Personal loans have become incredibly common in the United States. Economic pressures, rising healthcare costs, inflation, and emergencies push people to borrow. For many Americans, a personal loan feels like a lifeline — a bridge across financial uncertainty. But many do not realize that not all loans are created equal — and not all lenders operate ethically.

Some lenders rely on borrower confusion. Some depend on psychological manipulation. Some build revenue on penalties, not repayment.

Understanding the traps hidden in loan offers isn’t just smart — it’s financially protective.

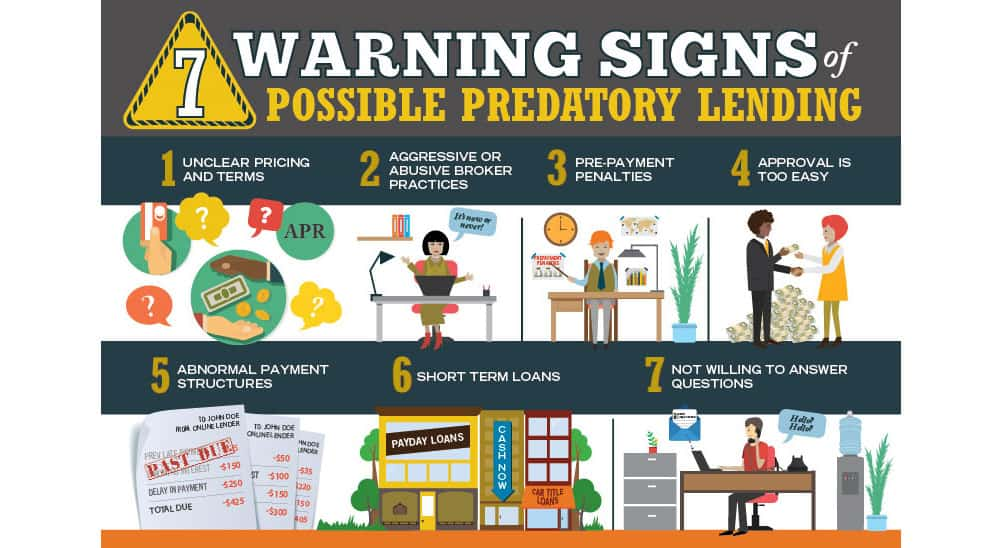

This article explores seven major warning signs that every borrower needs to know. If you’re considering a personal loan — or already have one — these insights may save you from months or years of unnecessary debt.

1. Too-Good-To-Be-True Interest Rates

We’ve all seen the ads:

- “LOANS STARTING AT 3.5% APR!”

- “INSTANT APPROVAL — LOWEST INTEREST GUARANTEED”

- “SUPER-LOW PROMOTIONAL RATE”

These rates often apply to only a tiny percentage of applicants — usually those with near-perfect credit (750-800+). Most borrowers will receive much higher rates, sometimes three to five times higher.

Real Example:

Erica applied for a $12,000 personal loan at an advertised 4.9%. After “risk assessment,” her actual approved APR was 18.2%.

Her reaction? She was already emotionally invested — she accepted anyway.

This is how lenders leverage momentum.

The golden rule:

If the advertised rate seems unrealistically low — it probably is.

2. Pressure to Accept Quickly — Artificial Urgency

You may see language such as:

- “This offer expires today!”

- “Lock in this rate NOW!”

- “Immediate action required”

- “Your pre-approval opportunity ends soon”

These urgency tactics are psychological pressure.

Lenders don’t want you to:

- think

- compare offers

- analyze documents

- research reviews

- talk to advisors

They want you to say YES emotionally — not analytically.

A legitimate offer gives you time. A predatory one rushes you.

3. Hidden Fees and Vague Charges

This is where lenders make quiet profits.

Watch out for:

- origination fees

- “loan processing” fees

- upfront service fees

- administrative fees

- disbursement fees

- convenience fees

- monthly “maintenance” fees

- prepayment penalties

Often these are buried under dense legal language — sometimes several pages deep.

Real Example:

Jon borrowed $6,000.

He received $5,400.

Why?

$600 was deducted as “processing and service fees,” even though it was never verbally explained.

Result: He owed $6,000 plus interest, but only received $5,400 in hand.

That’s a financial trap.

4. Encouraging You to Borrow More Than You Intended

This is a classic upsell tactic:

You request $8,000.

Lender says:

“You actually qualify for $18,000 — congratulations!”

This seems flattering. It feels empowering.

But it’s actually strategic.

More borrowed =

more interest paid =

more lender profit.

Borrowing more than necessary often leads to:

- longer repayment periods

- higher monthly payments

- interest accumulation

- higher total cost of borrowing

Borrow what you need — not what you can.

5. “No Credit Check” or “Guaranteed Approval” Loans

This is perhaps the biggest red flag.

Legitimate lenders assess risk.

If a company boasts:

- “Bad credit accepted!”

- “Guaranteed approval!”

- “No credit verification!”

…it means they are compensating risk with punishing interest rates — sometimes reaching 35–45%.

These lenders don’t care if you default — because they earn regardless through:

- penalty fees

- late fees

- rollover fees

- compounded interest

Avoid these offers at all costs.

6. Misleading Payment Presentation (Payment Masking)

Some lenders use deceptive payment framing:

- “Just $37/week!”

- “Only $5/day!”

- “Cheaper than a cup of coffee!”

Weekly payments feel small — but often mask:

- high interest accumulation

- extended repayment duration

- minimal principal reduction

- large final cost

Real Example:

Isabelle borrowed $9,000.

After 12 months of “low” weekly payments —

she still owed almost $8,000.

She wasn’t repaying principal —

she was paying interest.

A good loan reduces principal over time.

A bad one traps you in perpetual interest.

7. Prepayment Penalties — Punishing Responsibility

A smart borrower may plan:

“I’ll pay this off early when I get a bonus or tax return.”

But some loans sharply penalize early payoff through:

- interest loss fees

- balance-closure fees

- “contract breach penalties”

- early-termination charges

This forces you to remain trapped in the loan’s long-term payment structure — and keeps lenders earning more interest.

Any lender punishing early repayment should immediately raise concern.

How to Protect Yourself Before Signing Any Loan Agreement

Here is your practical borrower-safety checklist:

- NEVER accept the first loan offer without comparing

- ALWAYS read the full contract before signing

- DO NOT respond to time-pressure messaging

- ALWAYS calculate total cost of borrowing

- CHECK for fees, penalties, and rate variability

- ASK questions — don’t feel intimidated

- RESEARCH lender complaints, ratings, and reviews

- CONSULT a financial advisor or trusted expert if uncertain

Borrowing wisely is about clarity — not speed.

Questions Smart Borrowers Ask Before Signing

- “What is the true APR after final assessment?”

- “Are there origination or service fees?”

- “Will I be penalized for early repayment?”

- “How much will I have paid in total by the end?”

- “Does interest compound — and how often?”

- “Is interest front-loaded?”

- “Is this lender reputable?”

- “Do I genuinely need this full amount?”

Lenders notice borrowers who ask questions — and often treat them differently.

Frequently Asked Questions (10-Part Practical Guide)

1. Are high-interest loans always dangerous?

Not necessarily — but anything above ~20% APR should be scrutinized carefully.

2. Is it better to go to a bank or an online lender?

Banks and especially credit unions often provide safer, more regulated terms.

3. What credit score qualifies for good rates?

Generally 670+ gives access to fair or competitive rates.

4. Should I ever consider a “no-credit-check” loan?

Very rarely — these are almost always predatory.

5. Is it bad to borrow more than I need?

Yes — unnecessary borrowing increases payoff time and interest cost.

6. Why do lenders push urgency?

To keep you from analyzing terms. Quick decisions benefit them, not you.

7. Can I renegotiate a loan after accepting it?

Sometimes, especially with banks or credit unions — but rarely with online lenders.

8. Can I refinance a bad loan later?

Yes — refinancing into a lower-interest loan is often a smart exit strategy.

9. Is fixed interest better than variable?

Usually yes — fixed gives predictable payments and avoids rate surprises.

10. What is the biggest loan danger overall?

Hidden fees combined with psychological urgency — leading to uninformed commitment.

Final Insight: A Loan Can Save You or Sink You

A loan is not just paperwork and numbers — it’s a long-term financial relationship. It can:

- reduce stress,

- consolidate debt,

- fund dreams,

- create opportunity…

Or it can:

- drain income,

- cause anxiety,

- extend debt,

- damage credit.

The difference comes down to awareness.

Read slowly. Ask questions. Challenge assumptions. Protect yourself.

Loans are tools — not gifts.

Borrow strategically — not emotionally.