Refinance Horror Stories — And How You Can Avoid Their Fate

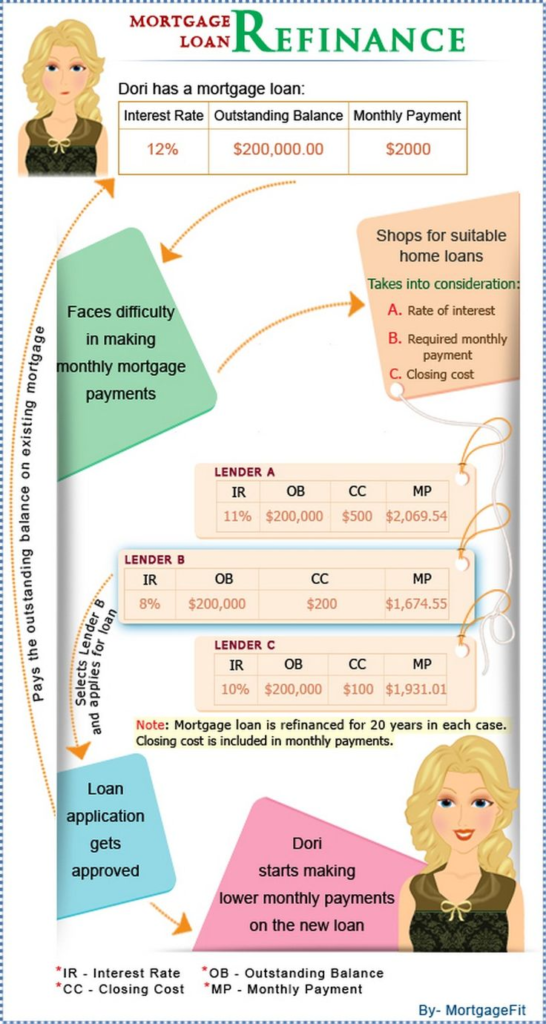

Refinancing can either be a smart financial strategy or a costly mistake. Many Americans have fallen into refinance traps that actually increased interest, extended debt timelines, and wiped out equity.…