Across the United States, real estate investors are quietly rewriting their playbook. The era of easy appreciation and speculative buying is fading, replaced by strategies centered on cash flow, downside protection, and long-term resilience. By shifting markets, property types, financing methods, and expectations, investors are adapting to realities many buyers haven’t fully recognized—yet.

Introduction: The Shift Most People Haven’t Noticed Yet

For much of the last decade, real estate investing looked deceptively simple. Buy almost anything, in almost any market, and wait. Prices rose, equity accumulated, and leverage amplified gains. Investors were rewarded for speed and confidence, not caution.

That world is gone.

What’s replacing it isn’t dramatic or headline-grabbing. There’s no mass exodus, no crash-driven panic. Instead, something quieter—and more important—is happening. Real estate investors are changing strategy in ways that fundamentally alter how the housing market functions.

They are buying differently.

They are underwriting differently.

They are thinking differently.

And most everyday buyers don’t yet realize what that means.

This article explains why real estate investors are quietly changing strategy, what they understand about the current market, and how those insights can help buyers, homeowners, and aspiring investors make smarter decisions.

Why Are Americans Asking: “Is Real Estate Still a Good Investment?”

Search trends reveal growing uncertainty. Questions like:

- “Are real estate investors still buying?”

- “Is real estate risky right now?”

- “What are investors doing in 2025?”

are being asked more frequently than at any point since the last housing downturn.

The reason is simple: the old rules no longer apply.

Low interest rates, rapid appreciation, and unlimited liquidity once masked risk. Today’s environment exposes it. Investors who have survived multiple cycles recognize the shift early—and adapt before the crowd.

What Actually Changed in the Real Estate Market?

To understand investor behavior today, you need to understand what stopped working.

The old investor model relied on:

- Cheap, abundant debt

- Constant price appreciation

- Fast exits

- Minimal attention to cash flow

That model struggles when:

- Borrowing costs rise

- Prices move sideways

- Buyers become cautious

- Expenses increase unpredictably

Instead of asking “How much will this be worth next year?”, investors now ask:

“How does this property perform if the market goes nowhere?”

That single question explains nearly every strategy shift happening today.

Are Real Estate Investors Leaving the Market?

This is one of the most misunderstood narratives.

No—investors are not abandoning real estate. But they are refusing bad deals.

Transaction volumes have slowed because:

- Sellers still price for yesterday’s market

- Returns don’t justify risk at current prices

- Investors are willing to wait

Walking away is now a strategy.

Investors aren’t bearish on real estate—they’re bearish on overpaying.

The End of Easy Appreciation (And Why That Matters)

For years, appreciation did the heavy lifting. Even properties with weak fundamentals eventually “worked” because prices kept rising.

That safety net is gone.

Today:

- Appreciation is slower

- Gains vary widely by location

- Some markets stagnate entirely

Without guaranteed appreciation, investors must rely on what they can control: income and expenses.

This shift separates disciplined investors from speculators.

Cash Flow Is King Again — But Not for the Reason You Think

Cash flow isn’t just about profit. It’s about survival.

Modern investors prioritize:

- Positive monthly income

- Conservative rent assumptions

- Realistic expense forecasts

- Adequate reserves

A property that barely breaks even becomes dangerous when:

- Insurance costs jump

- Taxes rise

- Vacancies last longer

- Repairs arrive unexpectedly

Cash flow provides margin for error—and margin for error is everything in uncertain markets.

Why Investors Are Buying in Different Cities Than Before

Location strategy has changed dramatically.

During the boom, investors chased the same markets everyone else did. Today, they’re deliberately avoiding them.

Investors now favor cities with:

- Affordable home prices relative to income

- Stable, diversified job markets

- Predictable population trends

- Landlord-friendly regulations

They care less about headlines and more about fundamentals.

That’s why secondary and tertiary markets—often overlooked by the media—are attracting disciplined capital.

The Rise of the Single-Family Rental (SFR) Strategy

Single-family rentals have become a cornerstone of modern investing.

Why?

Because they offer:

- Consistent tenant demand

- Familiar management dynamics

- Lower volatility in many regions

Instead of luxury homes, investors increasingly target modest, functional properties that appeal to long-term renters.

This is not about flipping. It’s about durable yield.

Multifamily Investing Hasn’t Died — It’s Been Repriced

Multifamily remains attractive, but underwriting standards have tightened significantly.

Investors are now cautious about:

- Overleveraged acquisitions

- Aggressive rent growth projections

- Underestimated operating costs

Deals that looked profitable two years ago no longer pass scrutiny.

Smart investors assume:

- Slower rent growth

- Higher expenses

- Longer holding periods

This realism is reshaping the multifamily landscape quietly—but decisively.

Financing Has Become a Core Strategy, Not an Afterthought

When rates were low, financing barely mattered. Today, it’s central.

Investors are:

- Using larger down payments

- Favoring fixed-rate debt

- Stress-testing loans under worst-case scenarios

The goal is no longer maximum leverage. It’s predictability.

Controlled risk beats theoretical upside.

Why Flipping Is Far Riskier Than It Used to Be

House flipping thrived in rising markets. That environment has changed.

Today’s flippers face:

- Longer holding times

- Price-sensitive buyers

- Higher carrying costs

- Narrower margins

As a result, many investors avoid flips entirely—or pursue only deeply discounted opportunities.

Speculation has been replaced by precision.

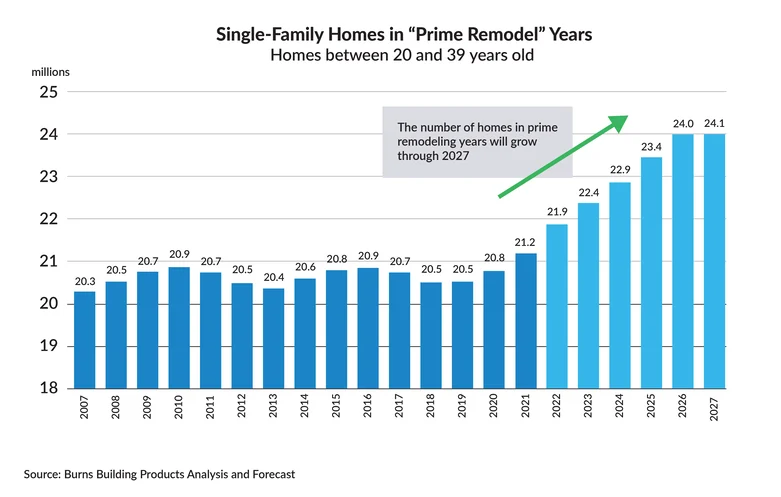

Investors Are Studying Demographics More Closely Than Ever

Demographics now drive investment decisions.

Investors analyze:

- Household formation trends

- Migration patterns

- Age distribution

- Rental demand drivers

Markets with stable, diversified populations outperform boom-and-bust regions over time.

Data—not hype—guides decisions.

Institutional Investors Are Quietly Adjusting Too

Large institutions never left the market—but their behavior changed.

Instead of aggressive accumulation, many are:

- Refining portfolios

- Selling underperforming assets

- Pausing acquisitions in overheated markets

This disciplined approach influences pricing and competition across the market.

A Real-Life Comparison: Two Investors, Two Outcomes

Consider two investors who bought similar properties.

Investor A bought during peak enthusiasm, relying on appreciation. Cash flow was thin. When expenses rose, stress followed.

Investor B waited, bought conservatively, and focused on income. Returns weren’t flashy—but they were reliable.

Same asset class. Different mindset. Completely different results.

What Everyday Buyers Can Learn From Investor Behavior

You don’t need to be an investor to learn from investors.

Key lessons include:

- Don’t rely on appreciation alone

- Stress-test affordability

- Build margin into decisions

- Plan for uncertainty

Investors assume things will go wrong—and prepare accordingly.

That mindset protects capital.

What This Means for the Housing Market Overall

Investor discipline leads to:

- Slower price growth

- Fewer speculative bubbles

- Healthier long-term stability

This isn’t bad news. It’s normalization.

Markets driven by fundamentals last longer than markets driven by hype.

Is Real Estate Still a Good Investment?

Yes—but only with realistic expectations.

Real estate is no longer:

- A guaranteed shortcut to wealth

- A low-effort play

It is:

- A long-term income asset

- A hedge against inflation when managed well

- A stability tool for disciplined investors

The opportunity didn’t disappear. The rules changed.

Practical Guidance for New or Small Investors

If you’re considering investing today, alignment matters more than timing.

Smart investor priorities include:

- Conservative underwriting

- Adequate reserves

- Local market knowledge

- Professional management

Patience is not inaction—it’s strategy.

What Homebuyers Should Understand About Investor Behavior

Many buyers fear competing with investors. Today, that fear is often misplaced.

Investors are:

- More selective

- Less aggressive

- Focused on numbers, not emotion

That creates space for owner-occupants who plan to live in their homes.

What the Next Phase of Real Estate Investing Looks Like

The next phase isn’t loud. It’s disciplined.

Expect:

- Fewer speculative headlines

- Longer hold periods

- Greater focus on income and resilience

The winners will be those who adapt quietly—not those who chase the past.

Frequently Asked Questions (FAQ)

1. Are real estate investors pulling out of the market?

No. They are becoming more selective and disciplined.

2. Why is cash flow so important again?

Because appreciation is slower and risk is higher.

3. Is flipping still profitable?

Only with strong margins and careful execution.

4. Are investors still buying single-family homes?

Yes, especially for long-term rental strategies.

5. Which markets do investors prefer now?

Affordable, stable markets with strong fundamentals.

6. Are high mortgage rates scaring investors away?

Rates matter, but financing strategy matters more.

7. Is multifamily still attractive?

Yes—but only with conservative assumptions.

8. Should new investors wait to buy?

Waiting can be smart if it improves deal quality.

9. Are institutional investors dominating housing?

Less aggressively than before; activity is more measured.

10. What’s the biggest mistake investors make today?

Relying on appreciation instead of cash flow.

Final Thoughts: The Smartest Moves Are Happening Quietly

Real estate investors didn’t panic when conditions changed. They adjusted.

They reduced leverage.

They demanded better deals.

They focused on fundamentals.

That quiet discipline is why they endure across cycles.

For buyers, sellers, and aspiring investors alike, the lesson is clear:

The era of easy wins is over—but the era of smart strategy has begun.