Before you trust a refinance quote or online savings estimate, it’s essential to understand that closing costs are the part of the process where lenders make refinancing significantly more expensive than it appears. With closing expenses often ranging from 2–5% of the loan balance, the true cost of refinancing can quickly outweigh the projected savings. This article explains the overlooked realities of closing costs and how to protect yourself from being overcharged.

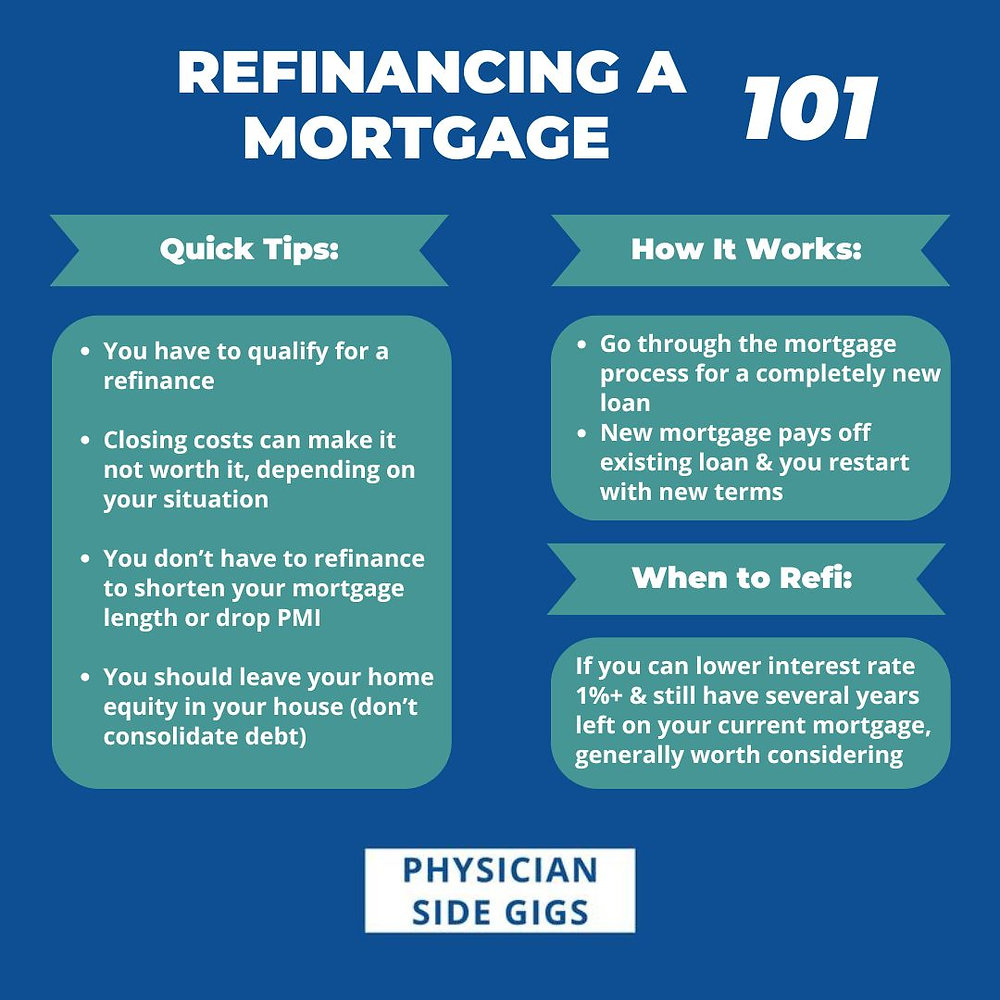

Refinancing your mortgage can seem like a savvy financial move — especially when interest rates dip or when you’re eager to reduce monthly payments. But beneath the appealing numbers lies a major cost component that many homeowners undervalue or don’t fully understand: closing costs. These are the silent financial burdens that can erode — or even completely eliminate — the gains you expect from refinancing.

According to the Consumer Financial Protection Bureau (CFPB), closing costs typically amount to 2–5% of the total loan value. On a $400,000 mortgage, this means paying between $8,000 and $20,000 just to complete the refinance. Unfortunately, many borrowers are unaware of this until the last minute — when the deal is nearly finalized, and it’s psychologically harder to walk away.

This article provides total clarity on closing costs — what they include, how they’re calculated, which ones are valid, which ones are negotiable, and how they impact the real bottom-line value of refinancing.

What Are Closing Costs in a Refinance — Really?

Closing costs are the combined fees charged to create, process, insure, record, and administer the new mortgage. They are distributed among banks, legal entities, title agencies, appraisers, insurance firms, and government offices.

They typically include:

- Loan origination fees

- Appraisal fees

- Title search and title insurance

- Underwriting fees

- Recording fees

- Tax service fees

- Survey fees

- Application fees

- Legal or attorney fees

- Prepaid interest

- Escrow funding

- Mortgage points

- Flood certification fees

- Courier and admin fees

But here’s the unpleasant truth: while some of these fees reflect real services, many are inflated, duplicated, or completely fabricated just to increase profit margins.

Real-Life Story: Elena’s “Savings” That Vanished

Let’s look at a real situation — one that’s far more common than most lenders admit.

Elena in Austin refinanced a $350,000 mortgage when her rate dropped from 4.9% to 4.2%. An online refinance calculator promised her:

“You will save $155 every month!”

That felt like a win.

But closing costs were:

$9,875

Her breakeven point was:

$9,875 / $155 ≈ 63 months

That’s more than 5 years before she actually starts saving.

Elena intended to move within 4 years.

That means she actually lost money refinancing — even though the interest rate was lower.

And you know who never showed her that reality?

The online calculator.

The lender.

The mortgage broker.

Everyone simply emphasized:

“Great news — your payment is lower!”

Are Your Closing Costs Being Manipulated?

The uncomfortable answer:

Very possibly — yes.

Closing cost manipulation techniques include:

- Consolidating fees into vague categories

- Using unfamiliar terminology

- Hiding fees in bundled line-items

- Making certain fees appear mandatory when they’re not

- Folding costs into loan principal

- Increasing the interest rate to cover waived fees

The biggest red flag?

When a lender says:

“We’ll show you the final fee details at closing.”

That’s like a mechanic saying:

“You’ll see the bill after the engine is already taken apart.”

You lose leverage once you’re invested.

The Deception of “No-Closing-Cost Refinancing”

One of the most deceptive refinance marketing hooks is:

“No closing costs!”

It’s everywhere — but here’s the fact:

No-closing-cost refinancing does not actually exist.

Instead, lenders:

- raise your interest rate,

- or add closing costs INTO your principal,

- or give lender credits that cost you more in interest long-term.

Example:

Real closing cost: $12,000

No-closing-cost pitch version:

- they increase your loan amount by $12,000

OR - you receive a higher rate by 0.25–0.75%

You end up paying far more than $12,000 over the life of the loan.

Banks never lose.

But borrowers often do.

Which Closing Fees Are Legit — and Which Are Junk?

Not all closing costs are scams. Some are legitimate, necessary, and regulated.

Fees that are generally legitimate:

- Appraisal fee

- Title search

- Recording fee

- State taxes and filing fees

- Attorney fees (required in certain states)

Fees that may be inflated or negotiable:

- Origination fees

- Underwriting fees

- Processing fees

- “Document preparation” fees

- Rate-lock fees

Fees that are often nonsense (“junk fees”):

- Courier fees

- “Investor delivery” charges

- “Funding verification” fees

- “Compliance review” fees

- “Warehouse line” fees

These are often made-up administrative charges designed simply to siphon money.

How Much Should Closing Costs Actually Cost?

A fair refinance closing cost structure is typically 2–3%, NOT 5%.

But many lenders push toward the higher end of the spectrum simply because most people never shop around.

In fact, Freddie Mac found that borrowers who received at least two rate quotes saved an average of $1,500, and those who received five quotes saved up to $3,000.

Borrowers who negotiate pay less.

Borrowers who accept the first offer pay more.

Why Online Refinance Calculators Rarely Include Closing Costs

Most online calculators are built by:

- banks

- loan brokers

- real estate platforms

- financial lead-generating sites

Their goal is closing a sale, not financial transparency.

Calculators focus on:

- interest rate

- monthly payment

And ignore:

- closing cost recovery timeline

- total loan interest

- amortization reset

- refinance risk

- homeowner’s actual timeline

They sell hope — not truth.

SEO-Optimized Question Sections

Do I actually save money after closing costs?

Only if you keep the loan long enough to pass the breakeven threshold.

Should I refinance if I plan to move within a few years?

Almost never — because closing costs rarely pay off in that timeframe.

Can I negotiate closing costs?

Yes — and you should. Many are discretionary.

Are closing costs tax-deductible?

Some are — particularly mortgage interest — but many are not.

Is rolling closing costs into the loan a bad idea?

Usually yes — because you pay interest on those costs.

Do credit unions have lower refinance fees?

Often yes — they tend to charge fewer junk fees.

Do larger banks charge more?

Often yes — especially via padded administrative charges.

Does refinancing later into the mortgage cost more?

It often does — because you restart interest accumulation.

Is a lower monthly payment always a good sign?

No — not if it extends total payoff time.

How can I estimate my breakeven point?

Divide closing costs by monthly savings — and evaluate future plans.

20 Important Practical Takeaways

- Always ask for a full itemized fee sheet

- Question every unfamiliar fee

- Request elimination of vague administrative charges

- Shop lenders — do not accept one quote

- Avoid refinancing late into your mortgage

- If fees exceed projected interest savings — don’t refinance

- Ask about title reissue discounts

- Never accept “fees disclosed at closing”

- Avoid rolling fees into principal

- Avoid increasing your loan rate to cover fees

- Always calculate breakeven time

- Consider staying with your current mortgage

- Ask: “Which fees are required by law?”

- Ask: “Which fees are lender-imposed?”

- Ask: “Can I use my existing appraisal?”

- Ask: “Can fees be waived or reduced?”

- Consider credit unions or local lenders

- Resist emotional decisions based solely on monthly payment

- View refinancing as a long-term strategy

- When uncertain — consult an independent advisor, not a lender

Final Thought: The True Cost of Refinancing Isn’t the Rate — It’s the Fine Print

Lenders want you focused on the shiny headline:

“Lower interest rate!”

But real financial maturity means analyzing:

- total cost

- total interest

- total fees

- total timeline

- total impact

A homeowner who understands amortization, equity, and closing cost dynamics is the one who actually wins financially — not the one who simply wants a lower monthly payment.

Smart refinancing requires seeing beyond the sales pitch — into the real cost hidden in closing paperwork.