If you’ve been renting and waiting for the right moment to buy, your opportunity may be arriving. With average 30-year fixed mortgage rates dipping toward the 6% range, smart buyers are leveraging this break to secure homes, build equity, and beat future rate hikes. This guide outlines why the timing matters, how renters can act, and what steps to take now.

Why This Mortgage-Rate Break is a Game-Changer for Renters

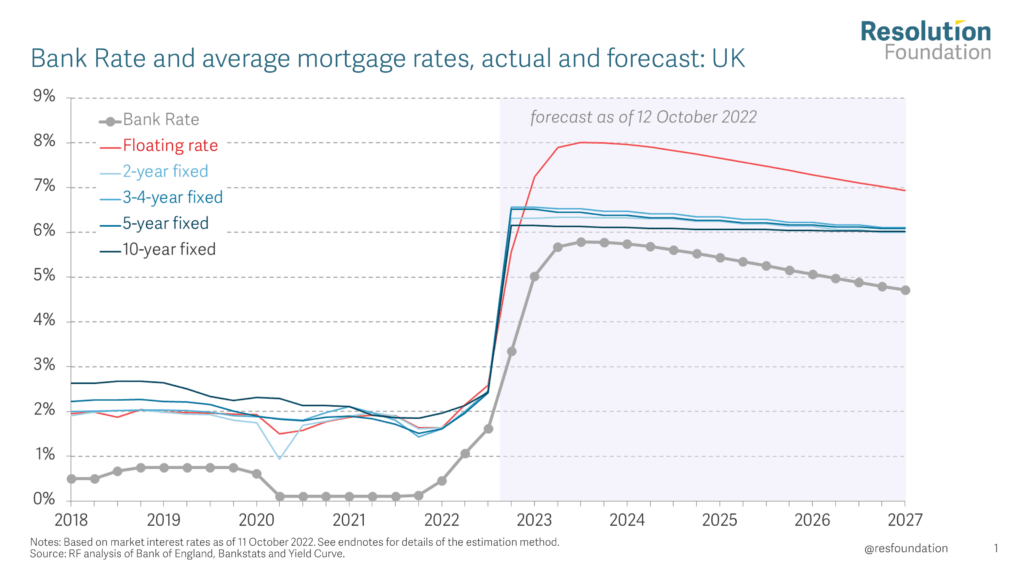

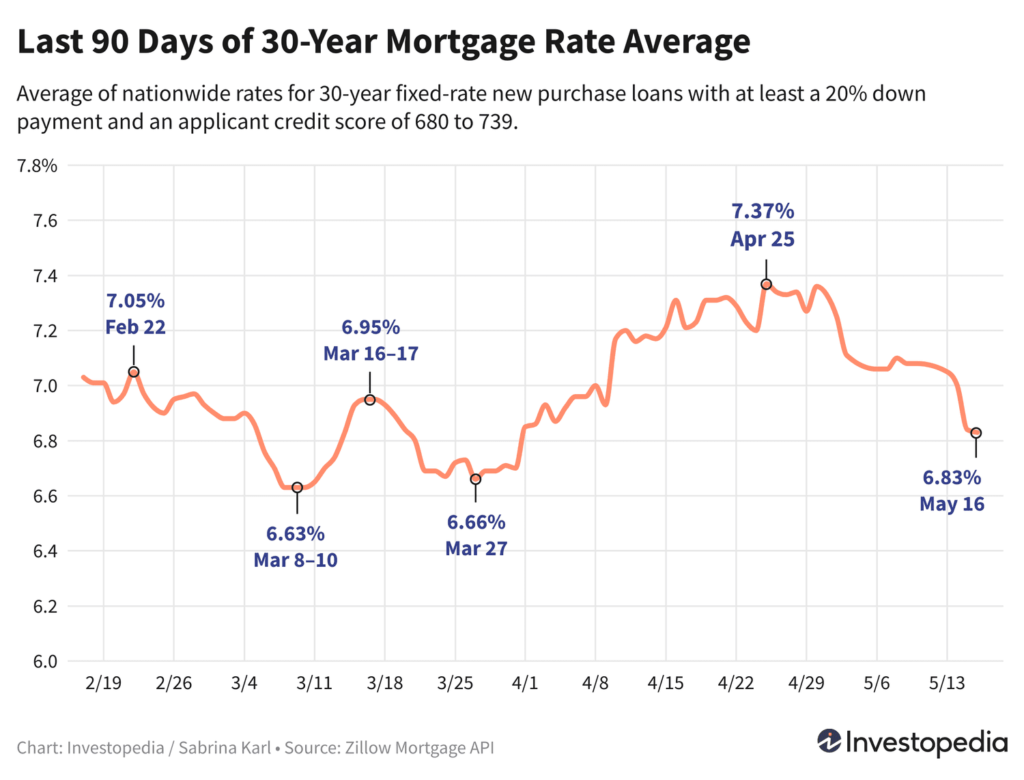

For years, many renters have watched the housing market and mortgage rates from the sidelines, frustrated by rates in the 7%+ range, which limited purchasing power. According to an analysis by Investopedia, the average 30-year fixed mortgage rate fell to about 6.50% from approximately 7.15% in mid-May 2025.

Meanwhile, per Freddie Mac, mortgage rates hit one of their lowest levels of the year—6.19% in late October 2025—creating a window of opportunity for buyers.

Why this matters for renters:

- Lower rates mean smaller monthly payments for the same loan amount—enhancing affordability.

- Renters are often paying significant sums that won’t build equity—buying at the right rate flips that dynamic.

- Less competition: Some buyers are still hesitant due to the high-rate era, giving motivated renters a better chance at negotiating favorable terms.

In short: The combination of lower rates plus fewer buyer obstacles = a strategic moment for renters ready to transition into homeownership.

What’s Really Driving the Rate Decline?

🔍 Key factors at play

- Falling Treasury yields: Since mortgage rates generally track the 10-year Treasury note, any drop there helps push mortgage rates down.

- Market expectations: As inflation signals moderate and the Federal Reserve pauses aggressive hikes, lenders and buyers anticipate rate relief.

- Builder and lender incentives: Some homebuilders are offering rate buy-downs to attract buyers in a slower market.

For renters considering buying, understanding these drivers matters not just for timing—but for realistic expectations. Rates may be lower than earlier this year, but they’re still higher than the ultra-low rates of the pandemic era.

Who’s Already Taking Advantage—and How Are They Doing It?

Real-World Example

Take Maria and James, longtime renters in Phoenix. In early 2025 they saw rates fall from ~7.1% to ~6.3%. By locking in at 6.3% on a $300,000 home with a 20% down payment, their monthly principal-and-interest payment dropped by approximately $120 compared to what it would have been at 7.1%. Over the life of the loan, that makes a large difference in total interest paid and cash flow.

Another example: A recent first-time buyer in Atlanta locked a rate at 6.25% during a builder incentive event—where the builder paid part of the buyer’s closing costs and secured a rate buy-down for them.

These examples show how renters can leap ahead by acting strategically—especially when rates dip and homes are competitively priced.

What Renters Should Ask Before Making the Move

Key questions to guide your readiness

- How stable is my income and employment? Buying makes more sense when your job is secure.

- What amount of down payment can I reasonably manage? A 20% down payment improves terms, but many programs allow less.

- What are other homeownership costs beyond the mortgage? Think property taxes, insurance, and maintenance.

- How long do I intend to stay in the home? If it’s less than 5–7 years, renting may still make sense depending on costs.

- Can I qualify for today’s rates based on credit, debt, and income? Locking a good rate requires strong financial standing.

Answering these honestly helps avoid buyer remorse and ensures the rate break works in your favor.

How to Make the Most of the Mortgage-Rate Break

✅ Action steps for smart renters ready to buy

- Get pre-approved early: Start with a mortgage pre-approval to understand exactly how much you can borrow.

- Watch the rate-lock window: Rates can move quickly—once you find a rate you’re comfortable with, lock it in.

- Explore builder/lender incentives: Ask about rate buy-downs, closing cost credits, or other perks.

- Budget for total ownership costs: Make sure your total monthly housing cost (mortgage + taxes + insurance + HOA) is comfortable.

- Keep flexibility for refinancing: If rates drop further, you may be able to refinance down the line—but don’t rely on it.

Use the current rate break as a strategic lever, not a guarantee that rates will plunge.

10 FAQs Renters Are Asking Right Now

1. Is now a good time for renters to buy?

Yes—if you are financially ready and plan to stay in the home for several years. Lower rates make buying more viable, but only when your personal readiness aligns.

2. How low are mortgage rates currently?

As of October 2025, the 30-year fixed rate dropped to around 6.19%.

3. Do I have to pay a huge down payment to lock a good rate?

Not necessarily. While 20% down gives better terms, many programs allow 5–10% or even less depending on loan type.

4. Can I refinance later if rates drop more?

Yes—but refinancing includes closing costs and eligibility criteria. Use the current rate break as an opportunity, not a guarantee of lower future rates.

5. Will housing prices matter more than rates?

Absolutely. A low rate won’t offset a home purchase if purchase prices are inflated. Always consider price + rate together.

6. What’s a realistic mortgage payment threshold for me?

A good guideline: Keep total monthly housing costs (mortgage + taxes + insurance) under 30% of your gross monthly income.

7. Can renters benefit from this if they lack perfect credit?

Yes. With sufficient down payment and income stability, many first-time buyer programs can bridge the credit gap—though better credit gets you better rates.

8. Is the rate break guaranteed to last?

No. Rates may move based on inflation, economic growth, or global events. Lock quickly if you find the terms you want.

9. What are other costs renters often overlook when buying?

Unexpected maintenance, homeowner association (HOA) fees, and closing costs are common hidden costs that renters usually don’t pay.

10. How do I compare renting vs buying given this rate break?

Calculate monthly cost of buying (including mortgage, taxes, insurance, maintenance) and compare it to your current rent + expected rent increases. If buying is comparable or lower and you plan to stay 5–7 years, you may be ahead.

What Smart Buyers Are Doing Right Now

Best-in-class strategies

- Target homes with strong value: Buyers are focusing on neighborhoods with slower appreciation—less bidding wars and better negotiating power.

- Leverage builder incentives: Some buyers capitalize on rate buy-downs and closing cost credits.

- Keep emergency reserves: Because homeownership includes maintenance costs, smart buyers maintain a cash buffer.

- Plan for the long term: Even if you only lock in the rate now, you’re building equity for future financial security.

These strategies separate reactive renters from proactive homeowners.

Final Takeaways for Renters Considering the Move

- Lower mortgage rates mean your window to move from renting to owning is wider now—but only if you’re ready.

- Being “ready” means stable income, down payment savings, manageable debt, and realistic length of stay.

- Use the current rate break as a launchpad, not a guarantee. Rate movement is unpredictable.

- Build in flexibility: A refinance may be possible later, but your primary buying decision should hinge on lifestyle, budget, and readiness now.

For many renters, the rate break isn’t just relief—it’s an invitation to step off the sidelines, build equity, and move toward a more stable, ownership-based housing future.