One extra percentage point in mortgage refinancing dramatically changes how much interest you pay over a loan’s lifetime. Even a 1% shift can cost or save tens of thousands of dollars due to the structure of mortgage amortization. This article explains the true cost of a single percentage point, using real-world math, real stories, and practical guidance on how to negotiate rates, evaluate long-term value, and avoid lender manipulation.

Refinancing a mortgage is often viewed as a strategic financial move, especially when interest rates dip or when homeowners want to reduce their monthly payments. Yet there is one factor that most Americans drastically underestimate: how much impact one single percentage point truly makes. The difference between a 5.0% rate and a 6.0% rate — or between 4.25% and 5.25% — may look small on paper, but mortgage math is deceptive. A seemingly tiny change can shift the entire economic outcome of your loan.

The brutal truth is that lenders understand this extremely well. Many borrowers do not. Banks make astronomical profit margins on interest differences — banking on the assumption that most homeowners think only in terms of monthly payment differences, not lifetime cost differences.

What Does “One Point” Really Mean in Refinancing?

A “point” in mortgage language refers to a 1% difference in interest rate. For example:

- 5.0% vs. 6.0%

- 6.5% vs. 7.5%

- 4.75% vs. 5.75%

This difference influences:

- total interest owed

- monthly payments

- loan payoff timeline

- equity accumulation

A one-point difference may feel like a marginal uptick. But in mortgage amortization — especially over a 20–30 year repayment period — it becomes enormous.

The $300,000 Example Every Homeowner Should See

Let’s break down a typical scenario involving identical borrowers, identical amounts, and identical terms — except for a 1% difference in interest rate.

Borrower A — Refinances at 5.0%

- Monthly Payment: $1,610

- Total Interest Paid Over 30 Years: $279,800

Borrower B — Refinances at 6.0%

- Monthly Payment: $1,799

- Total Interest Paid Over 30 Years: $347,500

Difference in monthly payment: $189

Difference in lifetime interest: $67,700

And here’s the catch…

Most borrowers pay attention only to the $189 difference.

They ignore the $67,700 difference.

That is how banks win — and consumers lose.

The Interest Curve That Banks Never Explain

Mortgage loans don’t apply interest evenly over time. They are front-loaded, which means:

- Early payments =Mostly interest

- Later payments =Mostly principal

When you refinance, you often restart the amortization schedule — putting you back into the heaviest interest period. That compounds the effect of one extra percentage point even more.

This is why:

- A 1% difference in interest

- Often results in

- A 10–20% difference in total interest paid over time

Why Lenders Push Slightly Higher Rates

Here’s how the industry plays the game:

- They know most borrowers are monthly-payment-focused.

- They offer the lower monthly payment narrative.

- They emphasize short-term relief.

- They minimize long-term cost.

Their favorite consumer mindset is:

“I don’t care about total interest — just tell me what I pay each month.”

This mindset costs homeowners tens of thousands of dollars.

The Great Psychological Trap: Wrong Number Focus

Borrowers typically ask:

- “Does refinancing lower my payment?”

They should ask:

- “Does refinancing lower my total repayment cost?”

A financially savvy homeowner doesn’t just chase lower monthly obligations — they chase lower total lifetime interest.

When Does One Extra Point Become Devastating?

A 1% difference is financially damaging when:

- you plan to stay in the home long-term

- you refinance early in your mortgage

- the refinance restarts amortization

- the loan balance is large

- you make only required payments and not extra principal payments

This scenario describes MOST borrowers.

When Does One Extra Point Matter Less?

There are exceptions where 1% is not a deal-breaker:

- you plan to move in 3–5 years

- you refinance into a 15-year or 10-year loan

- you aggressively prepay principal

- you eliminate PMI

- you move from ARM to fixed for security

In those cases, mortgage structure matters more than pure rate comparison.

Real-Life Story: Same Income, Two Outcomes

Couple A: Payment-Focused

They refinanced for a $200 monthly reduction.

Accepted a rate 1% higher than they could’ve gotten.

Couple B: Lifetime-Cost-Focused

They shopped multiple lenders.

Negotiated aggressively.

Waited for favorable conditions.

Ended up securing the lower rate.

10 years later:

- Couple A saved ~$24,000 in monthly payment relief

- BUT paid ~$46,000 more in interest

- Net loss: $22,000

Meanwhile:

- Couple B built equity faster

- Reduced interest

- Positioned themselves financially stronger

Same income. Same house value.

Different financial outcomes — due to one percentage point.

How to Avoid Paying That Extra Point

Here are strategic steps to negotiate and secure lower rates:

- Request written loan estimates from at least 5 lenders

- Ask for a breakdown of APR vs interest rate

- Ask for the “par rate” with no discount points

- Avoid lenders who hide broker compensation in fine-print

- Do not rush — timing matters

- Check credit score optimization before applying

- Consider using a mortgage broker to shop for you

One borrower may accept the first offer.

Another may challenge, compare, and leverage competition.

The second borrower almost always wins.

10 FAQs About Mortgage Points, Rate Differences & Refinancing

1. Does a 1% difference really matter in a 30-year mortgage?

Yes — it can cost $30,000 to $100,000 extra over time depending on loan size.

2. Why don’t banks highlight the lifetime cost difference?

Because they profit enormously when borrowers underestimate rate impact.

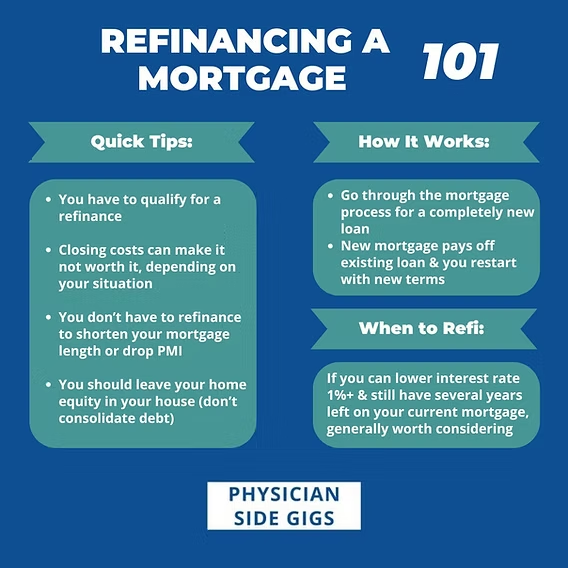

3. Is refinancing always beneficial when rates drop?

Only when it meaningfully reduces interest AND doesn’t extend the loan unnecessarily.

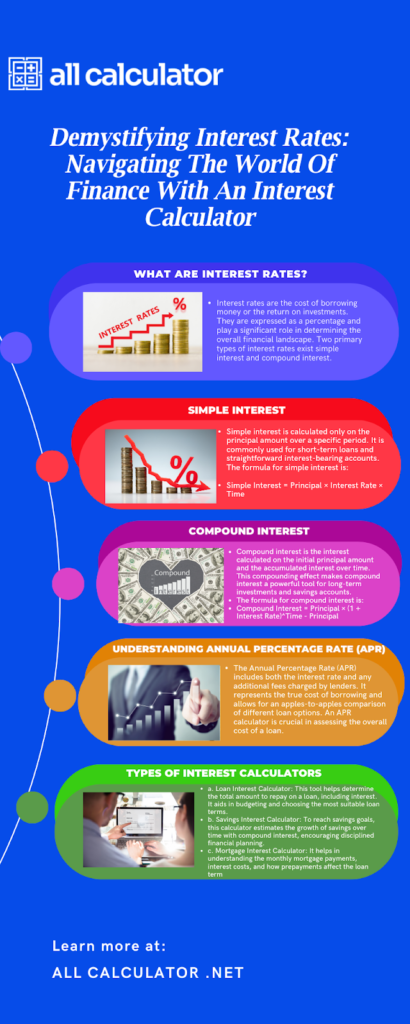

4. Should I focus more on APR or interest rate?

APR — because it includes fees and reflects the real cost of borrowing.

5. Can I negotiate the refinance rate?

Yes — and many borrowers secure better rates simply by asking or shopping around.

6. Is it better to refinance into a shorter loan term?

Often yes — shorter loans reduce total interest dramatically.

7. Should I refinance if planning to sell soon?

Probably not — rate differences matter less in short-ownership periods.

8. Does refinancing restart amortization?

Yes — and this makes early-loan years more interest-heavy.

9. What credit score is ideal for the best refinancing rates?

740+ typically unlocks the most favorable rate tiers.

10. Can paying extra principal offset a bad interest rate?

Somewhat — but overpaying principal does NOT undo the structural cost of higher interest.

Final Conclusion: A Single Point Isn’t Small — It’s Transformational

Interest looks deceptively small when expressed in whole numbers:

- 5% vs. 6%

- 4.25% vs. 5.25%

But the impact on your wealth, your savings, and your future is enormous.

The difference of one extra point can:

- extend your debt horizon

- slow equity growth

- drain potential investment capital

- limit financial flexibility

- erode future wealth

The smartest borrowers don’t just chase lower payments —

they chase optimal interest positioning and lifetime cost reduction.