A subtle mortgage mistake—like accepting a slightly higher rate, longer term, or failing to refinance—can quietly drain over $100,000 from your finances across the loan’s lifetime. Most Americans don’t notice it until it’s too late. Here’s what this hidden mistake is, how it works, and exactly how to avoid it when buying or refinancing in 2025.

The Hidden Mortgage Mistake That Costs Americans Six Figures

When most people think about mortgage mistakes, they picture the obvious ones: skipping inspections, underestimating property taxes, or choosing the wrong lender. But the real financial pitfall is often invisible—focusing on the monthly payment instead of the total loan cost.

This “affordable-payment mindset” leads borrowers to choose longer loan terms or higher interest rates, thinking they’re saving money. In reality, this simple oversight can add $100,000 or more to what they ultimately pay for their home.

According to Experian, even a 0.5% increase in mortgage interest on a $400,000 home can add tens of thousands of dollars in lifetime costs. (Source: Experian)

Why This Mistake Is So Dangerous in 2025

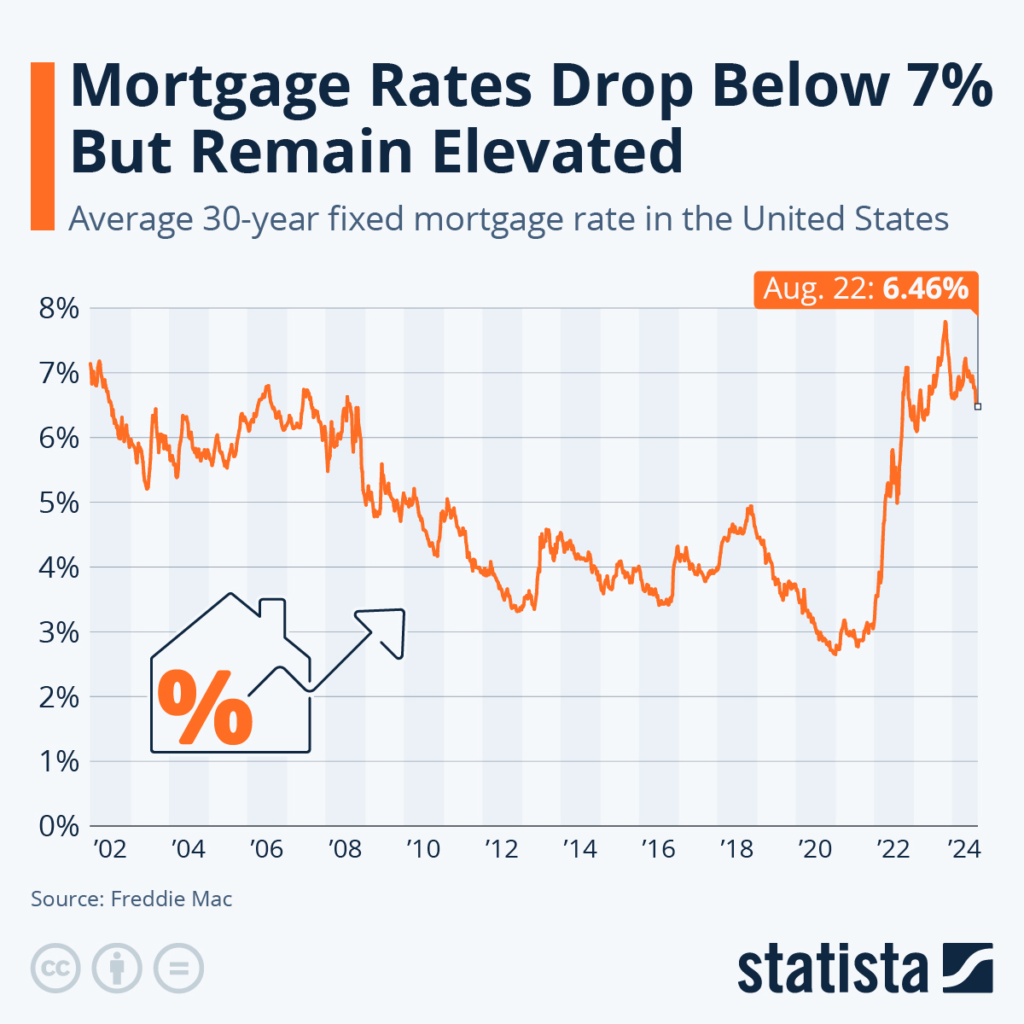

With interest rates hovering between 6% and 8% in 2025, borrowers are hyper-focused on qualifying for loans rather than optimizing them. Many accept whatever loan structure the lender offers—without fully understanding its long-term consequences.

Financial experts at Investopedia note that extending a mortgage term from 30 to 40 years could raise lifetime interest payments by over 35%, even though monthly payments drop only marginally. (Source: Investopedia)

In short: the longer and less-optimized your loan, the more you lose—even if it “feels affordable” today.

A Real-Life Example: Sandra vs. Michael

Let’s put real numbers to it.

Sandra’s Story

Sandra bought a home in Dallas for $450,000 with a 30-year fixed loan at 6.5%. It felt safe and affordable—her monthly payment was about $2,850.

But she never revisited the loan, never refinanced, and kept the same terms.

Six years later, rates dropped to 5%. If she had refinanced, she could’ve saved over $120,000 in interest. Instead, she’ll pay nearly half a decade more in interest-heavy payments before her principal even begins to shrink.

Michael’s Story

Michael bought a similar home but took a 15-year loan at 5.5%, increasing his payment to $3,400 per month.

The result? He saves over $140,000 in interest over the life of his loan and builds equity twice as fast. By year 15, he owns his home outright—while Sandra still owes hundreds of thousands.

The difference isn’t luck—it’s loan literacy.

What Causes This $100,000 Mistake?

Borrowers often fall into this trap for a few predictable reasons:

- They focus on monthly affordability, not total cost.

- They don’t compare offers across multiple lenders with identical terms.

- They choose longer terms (30–40 years) to reduce monthly payments.

- They ignore amortization schedules, never realizing how little early payments reduce the balance.

- They don’t refinance when rates or credit conditions improve.

- They underestimate PMI and fees that add hidden costs for years.

According to Bankrate, over 60% of borrowers fail to shop around for at least three quotes—costing them an average of $1,200 to $3,000 per year in unnecessary interest.

The Domino Effect of a “Small” Mortgage Error

A small rate difference or slightly longer term compounds dramatically over time. For example:

| Loan Amount | Interest Rate | Term | Total Interest Paid |

| $400,000 | 6.0% | 30 years | $463,000 |

| $400,000 | 6.5% | 30 years | $509,000 |

| $400,000 | 6.5% | 40 years | $606,000 |

That’s a $143,000 difference—for the same house.

How to Avoid the $100,000 Mortgage Trap

Here’s your action plan for smarter mortgage decisions in 2025:

✅ Before Buying

- Get at least 3–5 loan quotes and compare APRs, not just monthly payments.

- Use online mortgage calculators to project total lifetime cost.

- Consider shorter-term loans (15 or 20 years) if your budget allows.

- Keep your credit score above 740 to qualify for better rates.

- Make a larger down payment to reduce PMI and overall interest.

✅ After Buying

- Re-evaluate your loan every 12–18 months—especially after major rate changes.

- If rates drop ≥1%, calculate refinance break-even points.

- Pay extra toward principal monthly or make bi-weekly payments.

- Track amortization—know when interest finally stops dominating your payments.

- Avoid new debt that might increase refinance costs or loan risk category.

Even paying an extra $100/month toward principal on a 30-year mortgage can cut 5 years off your term and save over $60,000 in interest.

The Emotional Cost: Why Homeowners Miss This Mistake

The trap often feels emotional rather than financial. Many homebuyers want “peace of mind” and choose what looks easiest today. Mortgage terms are complex, and borrowers often fear overcomplicating decisions.

Lenders sometimes emphasize affordability (“You can get this home for just $2,800/month!”) instead of clarity (“You’ll pay $600,000 over 30 years”). That framing leads consumers to emotionally rationalize bad math.

The fix? Treat your mortgage like a long-term investment—one where small optimizations today multiply into six-figure savings tomorrow.

Top 10 Frequently Asked Questions (FAQs)

1. How much can a 0.5% interest rate difference cost me?

On a $400,000 loan, about $50,000–$60,000 over 30 years—without refinancing.

2. Is a 40-year mortgage ever worth it?

Usually not. It lowers monthly payments slightly but adds years of interest and drastically slows equity growth.

3. I’m planning to move in 5 years—should I care?

Yes. The first 5–7 years of a 30-year loan are interest-heavy, meaning minimal equity gain. Choosing shorter terms or larger payments builds faster equity.

4. Do extra principal payments really help?

Absolutely. Even small, consistent contributions can shave years off your loan and save tens of thousands in interest.

5. How do I know when to refinance?

If you can drop your rate by ≥0.75% and plan to stay for several years, refinancing often makes sense after accounting for closing costs.

6. What’s amortization, and why does it matter?

It’s how your payments split between interest and principal. Early on, most of your payment goes to interest. Understanding it helps you plan smarter payoff strategies.

7. How does a big down payment help?

It reduces your loan amount, lowers interest costs, and can eliminate PMI—saving thousands over the term.

8. Are adjustable-rate mortgages (ARMs) dangerous?

They can be. If rates rise after the fixed period, your payments may spike dramatically. Only use ARMs if you have a short-term exit strategy.

9. Can my credit score affect this mistake?

Yes. A lower credit score = higher interest rate = higher total cost. Improving your score before applying can save thousands.

10. What’s the best way to compare mortgage offers?

Look beyond monthly payments. Compare APR, total interest, closing costs, PMI, term length, and total loan cost over time.

The Bottom Line

The mortgage mistake that costs Americans six figures isn’t about missing paperwork or skipping inspections—it’s about misunderstanding how interest compounds.

By focusing only on monthly affordability, borrowers trade short-term comfort for long-term loss.

The key takeaway?

Think like an investor, not a borrower.

Every fraction of a percentage, every extra payment, and every refinancing opportunity adds up. Make your mortgage work for you—not against you.