Refinancing a mortgage can appear to be a smart financial move, promising lower monthly payments, access to home equity, or shorter loan terms. But under the wrong circumstances, it can become a costly money pit. High closing costs, extended loan terms, frequent refinancing, and cash-out strategies can result in higher long-term payments than sticking with your original mortgage. This guide explains when refinancing backfires, how to spot red flags, and strategies to protect your finances.

Why “Refinancing = Savings” Isn’t Always True

The idea of refinancing is widely marketed: lower interest rates, reduced monthly payments, or tapping into your home’s equity. While refinancing can be beneficial in certain cases, many homeowners discover the reality is more nuanced.

Upfront Costs Matter

Refinancing isn’t free. Closing costs typically range from 2% to 6% of the new loan amount (Bankrate). For example, refinancing a $250,000 mortgage could cost between $5,000 and $15,000 in fees alone. Many borrowers focus on the monthly savings without considering these significant upfront costs, which can negate any short-term gains.

Longer Loan Terms Can Hurt You

A critical mistake homeowners make is refinancing into a new 30-year mortgage, even after paying down a portion of their original loan. This “resetting the clock” approach may lower monthly payments but can dramatically increase total interest paid over the life of the loan (SmartAsset).

Small Monthly Savings May Not Be Worth It

Suppose your monthly payment drops by $100 after refinancing, but you paid $8,000 in closing costs. It would take over six years to reach the break-even point. Many homeowners do not plan for such timelines, meaning refinancing could end up costing more than it saves (Rocket Mortgage).

Cash-Out Refinances Carry Big Risks

Cash-out refinancing allows you to pull money from your home’s equity. While tempting, it can lead to higher monthly payments and increased lifetime interest, especially if the new loan carries a higher interest rate than your original mortgage (Responsible Lending).

Real-Life Stories: Refinancing Gone Wrong

Scenario 1: “Lower Payment” → Lifetime of Debt

Jessica and Mark refinanced their 30-year mortgage from 5.5% to 4.75%, thinking the $150 monthly savings was a win. But refinancing reset their loan term to 30 years, meaning they would pay tens of thousands more in interest over time than if they’d stayed on their original loan. Small monthly savings turned into decades of additional debt.

Scenario 2: Cash-Out Refi → Debt Spiral

David used a cash-out refinance to extract $40,000 in equity for home renovations. However, the new mortgage rate was 2–3 percentage points higher than his previous rate. Over seven years, he paid more in extra interest than the cash he pulled out, significantly increasing his financial burden.

Scenario 3: Frequent Refinancing — Small Gains, Big Losses

Some homeowners refinance multiple times, chasing lower rates or better terms. Economic research shows that frequent refinancing can produce “deadweight losses”, meaning borrowers repeatedly pay closing costs and reset their amortization schedule, ultimately paying more over time (UCLA Anderson Study).

Key Questions Homeowners Should Ask Before Refinancing

When Does Refinancing Make Sense?

- Significant rate drop: Experts recommend at least a 0.5%–1% reduction in interest rates to justify refinancing (Experian).

- Break-even point: You plan to stay in your home long enough for monthly savings to exceed upfront costs (Rocket Mortgage).

- Shorter term: Refinancing to a shorter loan term can reduce total interest paid, even if monthly payments increase.

When Can Refinancing Backfire?

- Large upfront costs and a short time horizon in the home.

- Minimal interest-rate reduction that doesn’t offset closing fees.

- Using cash-out refinancing in a high-rate environment.

- Repeated refinancing without meaningful savings (rate-churning).

Hidden Costs and Risks Many Borrowers Overlook

- Private Mortgage Insurance (PMI): Borrowers with less than 20% equity may need PMI, which increases monthly payments (SmartAsset).

- Credit Score Impact: Hard credit inquiries temporarily lower your score, and opening a new mortgage resets loan history (CACCU).

- Longer Debt Obligation: Restarting a 30-year loan after halfway through your original mortgage prolongs debt and delays equity accumulation.

- Cash-Out Refinancing Risk: Rising rates can make extracting equity expensive in the long run (Responsible Lending).

- Systemic inefficiency: Frequent refinancing can add inefficiencies to the mortgage market, increasing costs for borrowers (UCLA Anderson Study).

FAQs: What Homeowners Are Asking About Refinancing

1. Is refinancing always worth it if rates drop?

Not always. If the drop is small (e.g., 0.25%–0.50%), monthly savings may not justify the upfront costs (Experian).

2. How long should I stay in my home to break even?

For example, $8,000 in closing costs with $100 monthly savings equals 80 months (6 years, 8 months) to break even (Rocket Mortgage).

3. Does refinancing reduce total interest paid?

Not always. Extending the loan term can increase lifetime interest despite lower monthly payments (SmartAsset).

4. What is a cash-out refinance, and why is it risky now?

It replaces your mortgage with a larger one, giving you cash. Higher rates can make total interest exceed the cash received (Responsible Lending).

5. Are home equity loans or HELOCs better than cash-out refinancing?

Often yes. They allow accessing equity without losing the benefits of your original low-rate mortgage.

6. Can refinancing hurt my credit score?

Yes. Hard inquiries reduce scores temporarily, and closing one loan while opening another can reset your loan history (CACCU).

7. Should I refinance with less than 20% equity?

Be cautious; PMI may apply, increasing monthly costs and erasing savings (SmartAsset).

8. Is refinancing multiple times a good strategy?

Not usually. Repeated refinancing can increase fees and long-term costs (UCLA Anderson Study).

9. When is refinancing ideal?

It makes sense when you can secure a lower rate, shorten your loan term, stay in the home past the break-even date, or avoid rising payments without sacrificing equity.

10. What should I watch out for in refinance deals?

Avoid “no closing cost” offers with higher rates, and don’t refinance for small monthly savings without calculating long-term impact (SmartAsset).

Practical Steps to Avoid Getting Burned

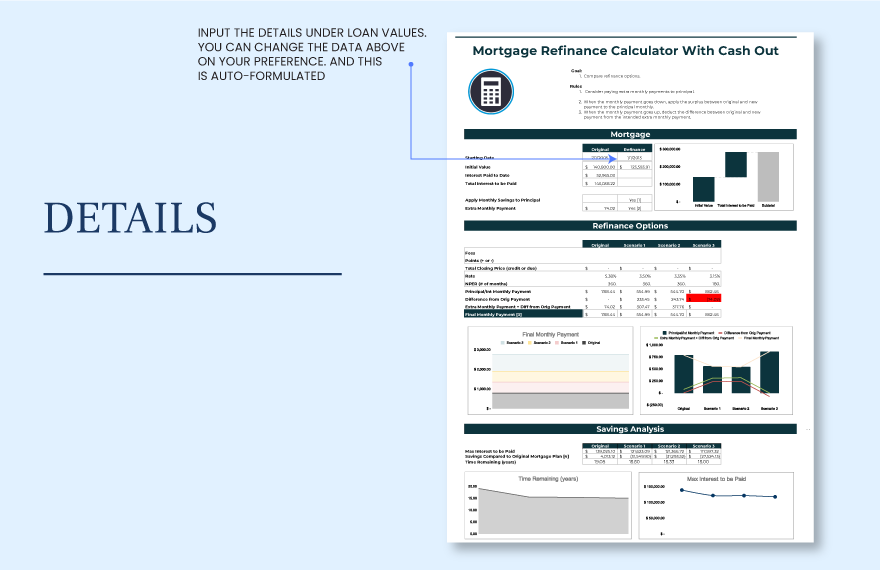

- Run the numbers: Use calculators to estimate break-even points and total interest.

- Compare multiple lenders: Your current lender may not offer the best rate.

- Consider alternatives to cash-out refinancing: HELOCs or home equity loans may be smarter.

- Avoid refinancing for trivial savings: Focus on meaningful financial benefits.

- Ensure a long-term stay: Break-even calculations assume you stay beyond upfront cost recovery.

- Factor in hidden costs: PMI, closing fees, interest, and potential rate increases can add up.

Broader Insights: Systemic Refinance Risks

Research shows that repeated refinancing not only affects individual homeowners but can create inefficiencies in the mortgage market. Repeated refinancing leads to “deadweight losses” — borrowers pay extra fees and interest while lenders profit. Awareness of this dynamic is essential: it reminds homeowners to approach refinancing strategically, not impulsively (UCLA Anderson Study).

Final Thoughts — Avoid the Refinancing Trap

Refinancing can be beneficial, but it’s not a guaranteed shortcut to savings. Homeowners often refinance for lower payments or access to cash, only to discover higher long-term costs. The key is to act like a savvy investor: run the numbers, consider alternatives, understand the break-even point, and resist chasing minor rate drops.

Approach refinancing strategically, factoring in interest, equity, term length, and hidden costs. Done correctly, refinancing can save you money, shorten debt, or unlock valuable equity — but done carelessly, it can become a long-term money pit.

–xxx–

Video Link-https://www.youtube.com/watch?v=bezKnZCRcjE